Summary

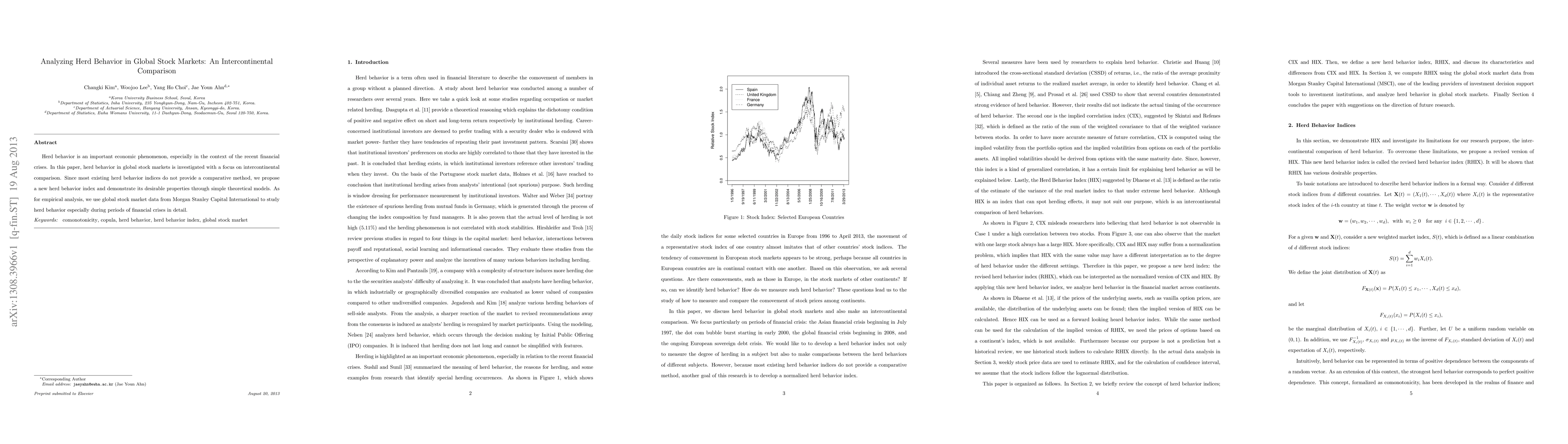

Herd behavior is an important economic phenomenon, especially in the context of the recent financial crises. In this paper, herd behavior in global stock markets is investigated with a focus on intercontinental comparison. Since most existing herd behavior indices do not provide a comparative method, we propose a new herd behavior index and demonstrate its desirable properties through simple theoretical models. As for empirical analysis, we use global stock market data from Morgan Stanley Capital International to study herd behavior especially during periods of financial crises in detail.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)