Authors

Summary

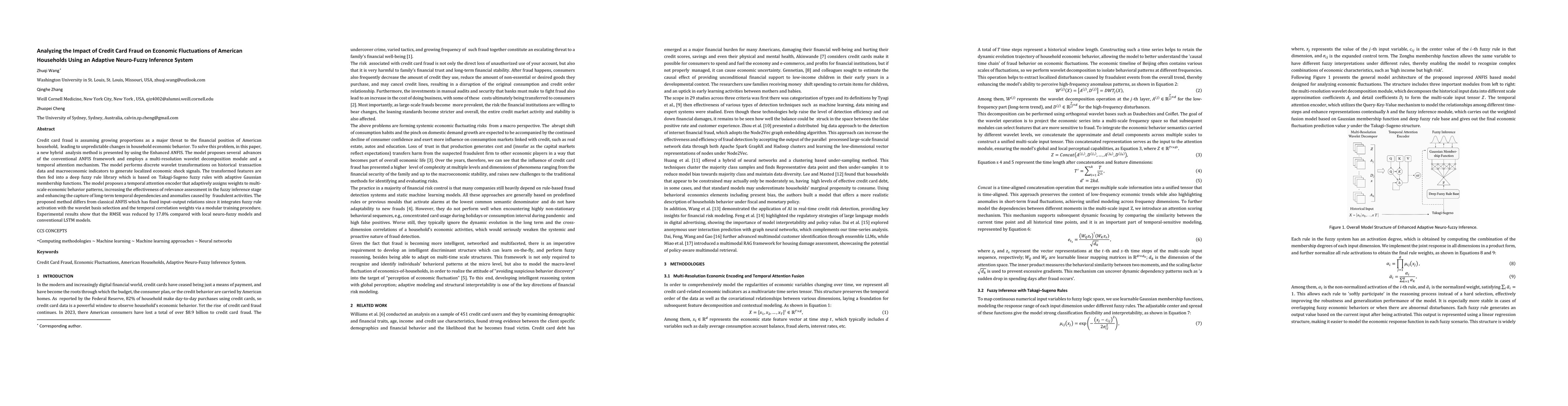

Credit card fraud is assuming growing proportions as a major threat to the financial position of American household, leading to unpredictable changes in household economic behavior. To solve this problem, in this paper, a new hybrid analysis method is presented by using the Enhanced ANFIS. The model proposes several advances of the conventional ANFIS framework and employs a multi-resolution wavelet decomposition module and a temporal attention mechanism. The model performs discrete wavelet transformations on historical transaction data and macroeconomic indicators to generate localized economic shock signals. The transformed features are then fed into a deep fuzzy rule library which is based on Takagi-Sugeno fuzzy rules with adaptive Gaussian membership functions. The model proposes a temporal attention encoder that adaptively assigns weights to multi-scale economic behavior patterns, increasing the effectiveness of relevance assessment in the fuzzy inference stage and enhancing the capture of long-term temporal dependencies and anomalies caused by fraudulent activities. The proposed method differs from classical ANFIS which has fixed input-output relations since it integrates fuzzy rule activation with the wavelet basis selection and the temporal correlation weights via a modular training procedure. Experimental results show that the RMSE was reduced by 17.8% compared with local neuro-fuzzy models and conventional LSTM models.

AI Key Findings

Generated Sep 30, 2025

Methodology

The study employs an Enhanced ANFIS framework integrating multi-resolution wavelet decomposition and a temporal attention mechanism to analyze credit card fraud's impact on household economic fluctuations. It uses CardSim simulator data to evaluate socio-economic effects through comparative experiments with LightGBM, TabNet, Autoformer, and DeepFM.

Key Results

- The proposed method reduced RMSE by 17.8% compared to local neuro-fuzzy models and conventional LSTM models.

- The model achieved higher AUC-ROC scores, demonstrating improved fraud detection sensitivity and reduced false alarm rates.

- The Debt Acceleration Index (DAI) showed the model's superior sensitivity in capturing debt burden increases due to fraud.

Significance

This research provides a robust framework for understanding and mitigating credit card fraud's economic impact on households, offering insights for financial institutions and policymakers to enhance fraud detection and economic stability.

Technical Contribution

The paper introduces a hybrid model combining wavelet decomposition, temporal attention mechanisms, and Takagi-Sugeno fuzzy rules to enhance fraud detection and economic fluctuation analysis.

Novelty

The work innovates by integrating multi-resolution wavelet decomposition with temporal attention in ANFIS, enabling more accurate detection of fraud-induced economic anomalies compared to traditional methods.

Limitations

- The study relies on simulated CardSim data which may not fully represent real-world transaction complexities.

- The model's performance is evaluated primarily on fraud detection metrics, with limited analysis of long-term economic recovery patterns.

Future Work

- Introduce online learning and adaptive rule updating mechanisms to handle evolving fraud patterns.

- Extend the model to other financial products like debit cards and digital wallets.

- Explore the model's interpretability and policy application value for regulatory frameworks.

Paper Details

PDF Preview

Similar Papers

Found 5 papersDetection and Impact of Debit/Credit Card Fraud: Victims' Experiences

Eman Alashwali, Lorrie Faith Cranor, Ragashree Mysuru Chandrashekar et al.

Credit Card Fraud Detection: A Deep Learning Approach

Sourav Verma, Joydip Dhar

Credit Card Fraud Detection Using Asexual Reproduction Optimization

Mohammadreza Fani Sani, Anahita Farhang Ghahfarokhi, Taha Mansouri et al.

Comments (0)