Authors

Summary

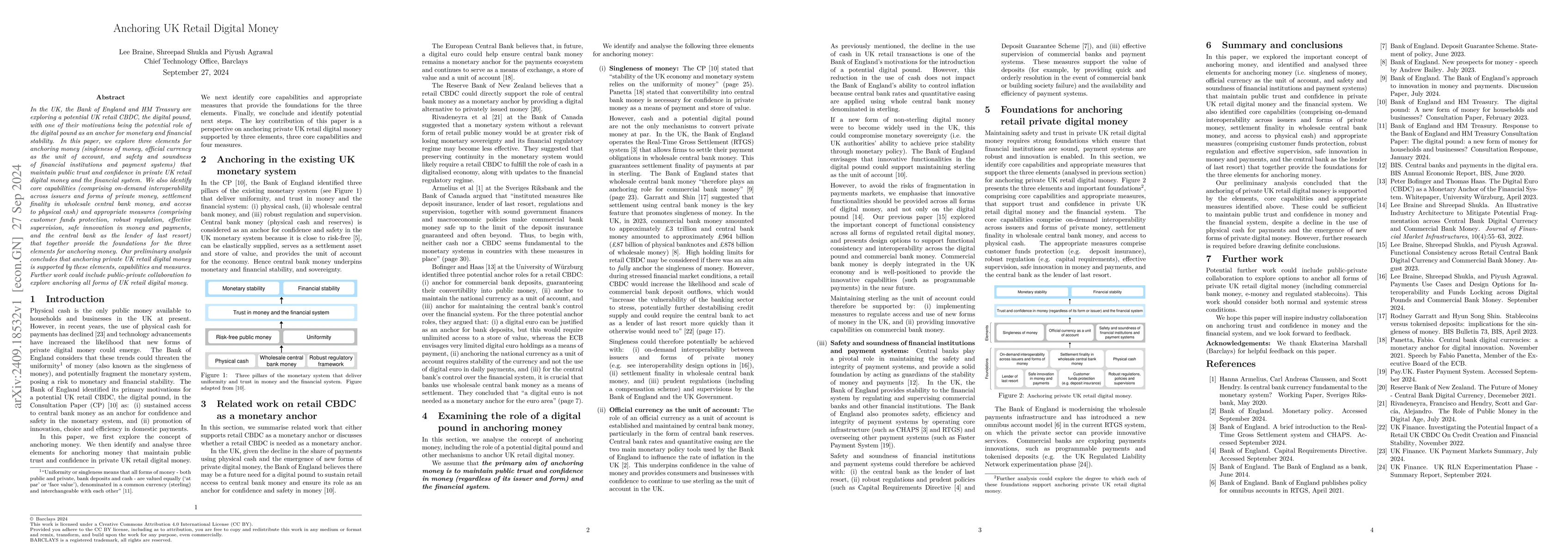

In the UK, the Bank of England and HM Treasury are exploring a potential UK retail CBDC, the digital pound, with one of their motivations being the potential role of the digital pound as an anchor for monetary and financial stability. In this paper, we explore three elements for anchoring money (singleness of money, official currency as the unit of account, and safety and soundness of financial institutions and payment systems) that maintain public trust and confidence in private UK retail digital money and the financial system. We also identify core capabilities (comprising on-demand interoperability across issuers and forms of private money, settlement finality in wholesale central bank money, and access to physical cash) and appropriate measures (comprising customer funds protection, robust regulation, effective supervision, safe innovation in money and payments, and the central bank as the lender of last resort) that together provide the foundations for the three elements for anchoring money. Our preliminary analysis concludes that anchoring private UK retail digital money is supported by these elements, capabilities and measures. Further work could include public-private collaboration to explore anchoring all forms of UK retail digital money.

AI Key Findings

Generated Sep 07, 2025

Methodology

The research explores the concept of anchoring money in the context of a potential UK retail CBDC (digital pound), analyzing three elements for maintaining public trust and confidence in private UK retail digital money and the financial system.

Key Results

- Three elements for anchoring money identified: singleness of money, official currency as the unit of account, and safety and soundness of financial institutions and payment systems.

- Core capabilities (on-demand interoperability, settlement finality, and access to physical cash) and appropriate measures (customer funds protection, robust regulation, effective supervision, safe innovation, and the central bank as the lender of last resort) are identified to support the anchoring elements.

- Preliminary analysis concludes that anchoring private UK retail digital money is supported by these elements, capabilities, and measures.

Significance

This research is important as it addresses the potential risks to monetary and financial stability posed by the decline in physical cash usage and the emergence of new forms of private digital money, offering a perspective on how to maintain public trust and confidence in UK retail digital money.

Technical Contribution

The paper presents a framework for anchoring private UK retail digital money, identifying key elements, core capabilities, and appropriate measures that together ensure monetary and financial stability.

Novelty

This work contributes to the ongoing discourse on central bank digital currencies by specifically focusing on the UK context and offering a comprehensive analysis of the elements, capabilities, and measures necessary to anchor private retail digital money.

Limitations

- The paper is preliminary and further work is required before drawing definitive conclusions.

- The analysis does not account for all potential future developments in technology and market dynamics.

Future Work

- Explore public-private collaboration to anchor all forms of UK retail digital money.

- Investigate the impact of a digital pound under both normal and systemic stress conditions.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersFunctional Consistency across Retail Central Bank Digital Currency and Commercial Bank Money

Piyush Agrawal, Lee Braine, Shreepad Shukla

Retail Central Bank Digital Currency: Motivations, Opportunities, and Mistakes

Tomaso Aste, Geoffrey Goodell, Hazem Danny Al-Nakib

Print Your Money: Cash-Like Experiences with Digital Money

Ye Wang, Roger Wattenhofer, Yu Chen et al.

Payments Use Cases and Design Options for Interoperability and Funds Locking across Digital Pounds and Commercial Bank Money

Piyush Agrawal, Aishwarya Nair, Lee Braine et al.

No citations found for this paper.

Comments (0)