Authors

Summary

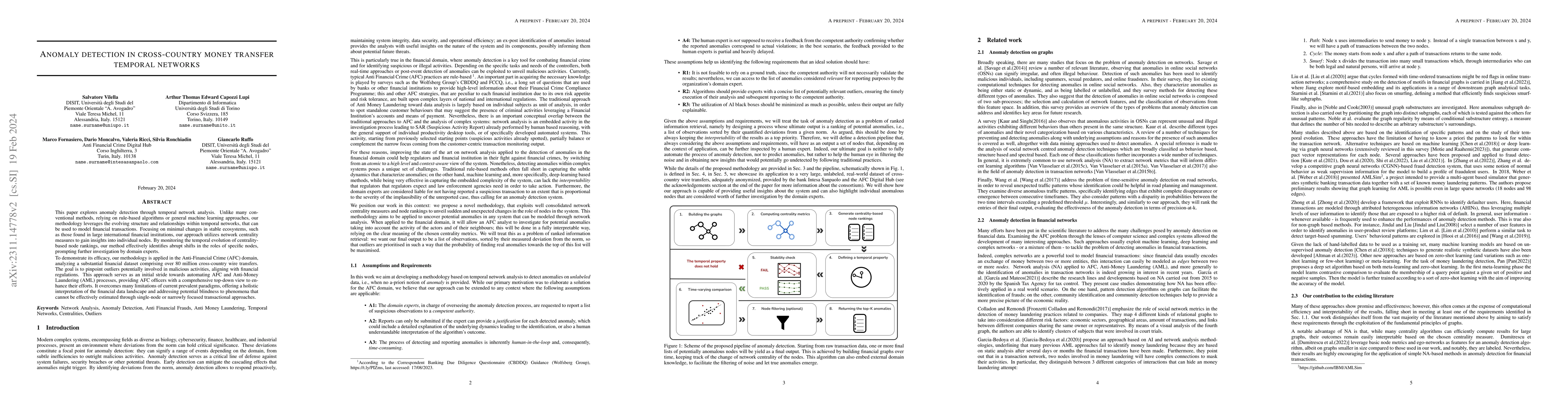

This paper explores anomaly detection through temporal network analysis. Unlike many conventional methods, relying on rule-based algorithms or general machine learning approaches, our methodology leverages the evolving structure and relationships within temporal networks, that can be used to model financial transactions. Focusing on minimal changes in stable ecosystems, such as those found in large international financial institutions, our approach utilizes network centrality measures to gain insights into individual nodes. By monitoring the temporal evolution of centrality-based node rankings, our method effectively identifies abrupt shifts in the roles of specific nodes, prompting further investigation by domain experts. To demonstrate its efficacy, our methodology is applied in the Anti-Financial Crime (AFC) domain, analyzing a substantial financial dataset comprising over 80 million cross-country wire transfers. The goal is to pinpoint outliers potentially involved in malicious activities, aligning with financial regulations. This approach serves as an initial stride towards automating AFC and Anti-Money Laundering (AML) processes, providing AFC officers with a comprehensive top-down view to enhance their efforts. It overcomes many limitations of current prevalent paradigms, offering a holistic interpretation of the financial data landscape and addressing potential blindness to phenomena that cannot be effectively estimated through single-node or narrowly focused transactional approaches.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersDeep Learning for Cross-Border Transaction Anomaly Detection in Anti-Money Laundering Systems

Zhen Xu, Qian Yu, Zong Ke

Temporal Graph Networks for Graph Anomaly Detection in Financial Networks

Yongjae Lee, Yejin Kim, Youngbin Lee et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)