Summary

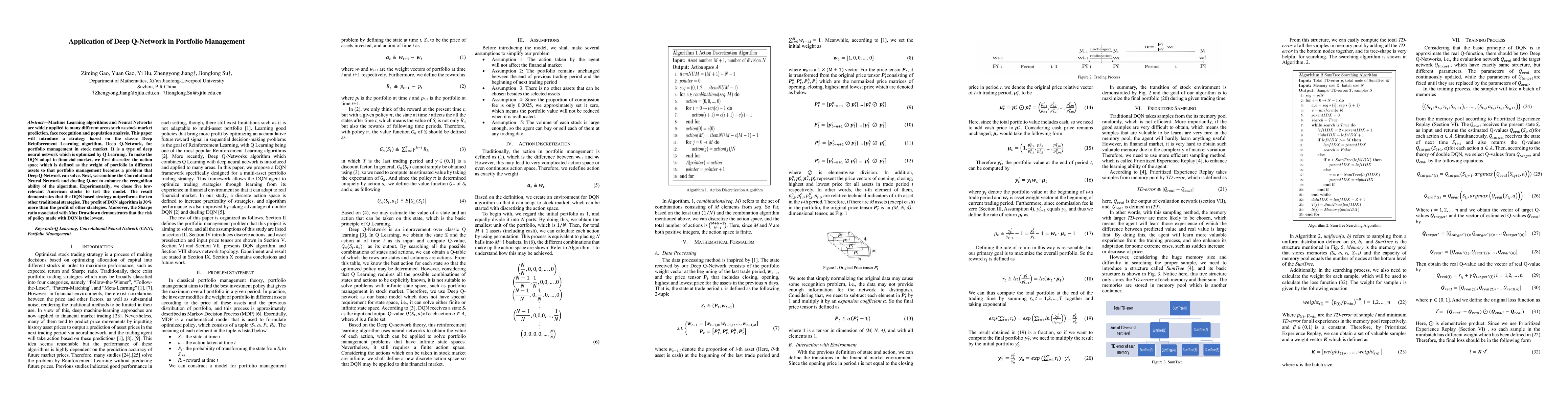

Machine Learning algorithms and Neural Networks are widely applied to many different areas such as stock market prediction, face recognition and population analysis. This paper will introduce a strategy based on the classic Deep Reinforcement Learning algorithm, Deep Q-Network, for portfolio management in stock market. It is a type of deep neural network which is optimized by Q Learning. To make the DQN adapt to financial market, we first discretize the action space which is defined as the weight of portfolio in different assets so that portfolio management becomes a problem that Deep Q-Network can solve. Next, we combine the Convolutional Neural Network and dueling Q-net to enhance the recognition ability of the algorithm. Experimentally, we chose five lowrelevant American stocks to test the model. The result demonstrates that the DQN based strategy outperforms the ten other traditional strategies. The profit of DQN algorithm is 30% more than the profit of other strategies. Moreover, the Sharpe ratio associated with Max Drawdown demonstrates that the risk of policy made with DQN is the lowest.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)