Summary

The purpose is to promote the orderly development of China's Internet financial transactions and minimize default and delinquency in Internet financial transactions. Based on the typical big data algorithm (K-means algorithm), this paper discusses the concepts of the K-means algorithm and Internet financial transactions, as well as the significance of big data algorithms for Internet financial transaction data evaluation and statistical analysis. Meanwhile, the existing Internet financial transaction systems are reviewed, and their deficiencies are summarized, based on which relevant countermeasures and suggestions are put forward. At the same time, the K-means clustering algorithm is applied to evaluate financial transaction data, finding that it can improve the accuracy of data and reduce the error by 40%. But when the number of clusters is 7, the output result distribution interval of the K-means clustering algorithm is 4 days, and when the number of clusters is 10, the output result distribution interval of the K-means clustering algorithm is 6 days, indicating that the convergence effect of this algorithm is relatively good. Additionally, many small and micro individuals still hold a negative attitude towards the innovation and adjustment of Internet financial transactions, indicating that the construction of China's Internet financial transaction system needs further optimization. The satisfaction of most small and micro individuals with innovation and adjustment also shows that the proposed Internet financial transaction adjustment measures are feasible, can provide references for relevant Internet financial transactions, and contributes to the development of Internet financial transactions in China.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

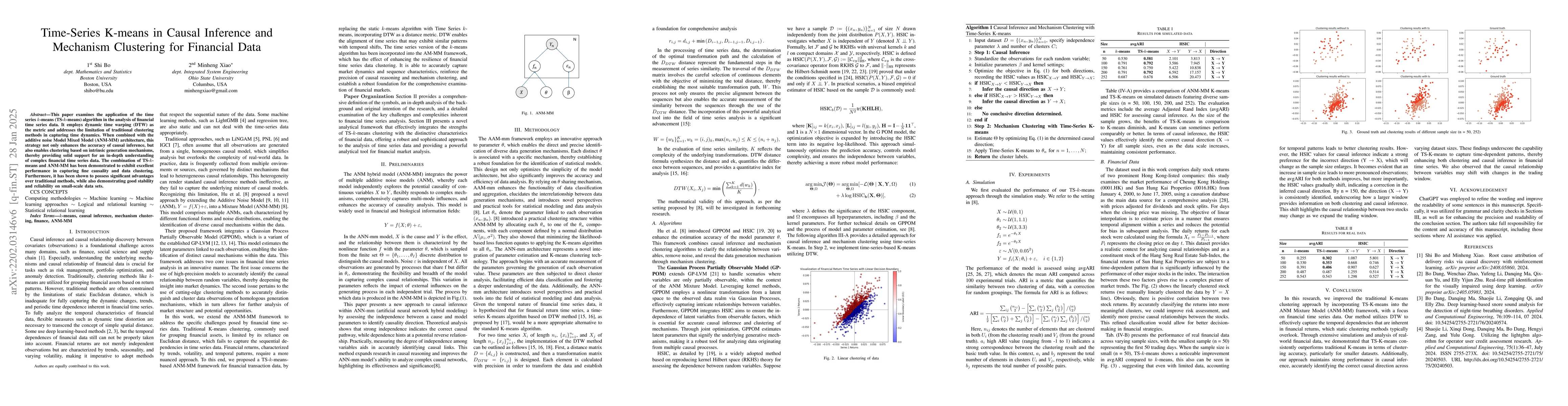

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersA K-means Algorithm for Financial Market Risk Forecasting

Yue Wang, Jinxin Xu, Ruisi Li et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)