Authors

Summary

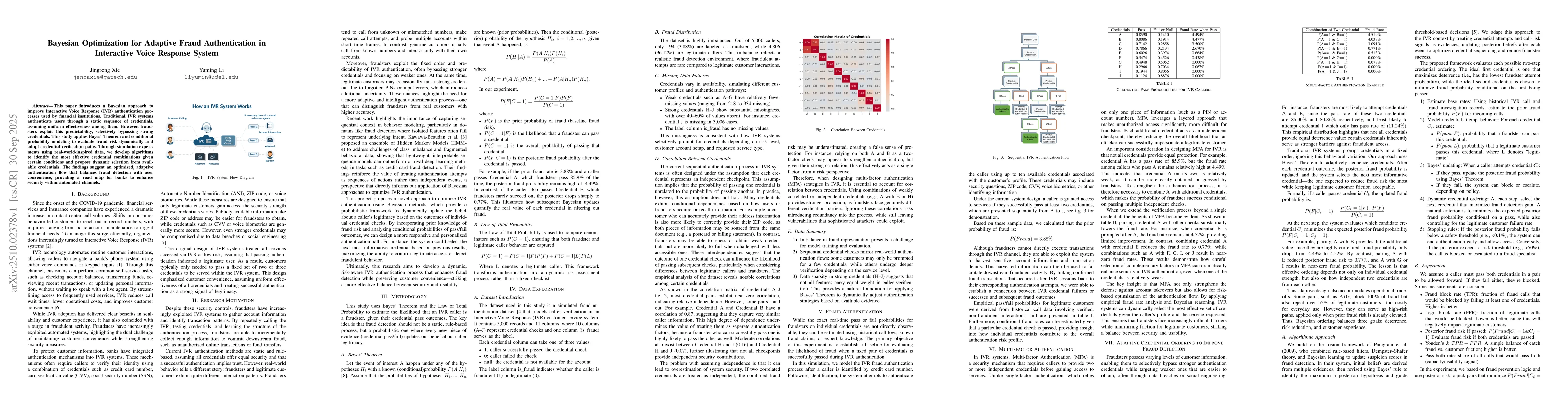

This paper introduces a Bayesian approach to improve Interactive Voice Response (IVR) authentication processes used by financial institutions. Traditional IVR systems authenticate users through a static sequence of credentials, assuming uniform effectiveness among them. However, fraudsters exploit this predictability, selectively bypassing strong credentials. This study applies Bayes' Theorem and conditional probability modeling to evaluate fraud risk dynamically and adapt credential verification paths.

AI Key Findings

Generated Oct 12, 2025

Methodology

The research employs Bayesian inference combined with empirical pass/fail data to dynamically assess and update fraud risk during IVR authentication. It models credential attempt behavior and uses posterior probability updates to adaptively select authentication steps based on real-time outcomes.

Key Results

- Certain credential pairs (e.g., A+E) reduce fraud risk by sixfold compared to others (e.g., A+B).

- Adaptive sequencing of credentials based on previous outcomes significantly lowers posterior fraud probabilities, achieving 0% observed fraud in some cases.

- Dynamic credential ordering enables fraud detection gains while minimizing legitimate customer friction.

Significance

This research transforms static IVR authentication into a risk-aware, intelligent process that enhances fraud prevention while preserving customer experience, offering practical solutions for financial institutions.

Technical Contribution

Develops a Bayesian framework for adaptive IVR authentication that dynamically updates fraud risk assessments and selects optimal credential verification sequences based on real-time data.

Novelty

Introduces an intelligent, risk-aware IVR authentication system that combines empirical data with Bayesian inference for adaptive fraud detection, differing from traditional static authentication methods.

Limitations

- Assumes access to accurate credential-level pass rate estimates, which may be challenging to obtain in practice.

- Focuses primarily on two-step authentication paths, limiting exploration of multi-step adaptive flows.

Future Work

- Explore methods to dynamically learn credential probabilities from real-time data using Bayesian updating or machine learning.

- Extend the framework to multi-step adaptive flows for improved fraud detection with minimal customer friction.

- Model legitimate customer behavior more comprehensively, including failure rates and abandonment patterns.

Paper Details

PDF Preview

Similar Papers

Found 5 papersEvolution of IVR building techniques: from code writing to AI-powered automation

Khushbu Mehboob Shaikh, Georgios Giannakopoulos

Comments (0)