Summary

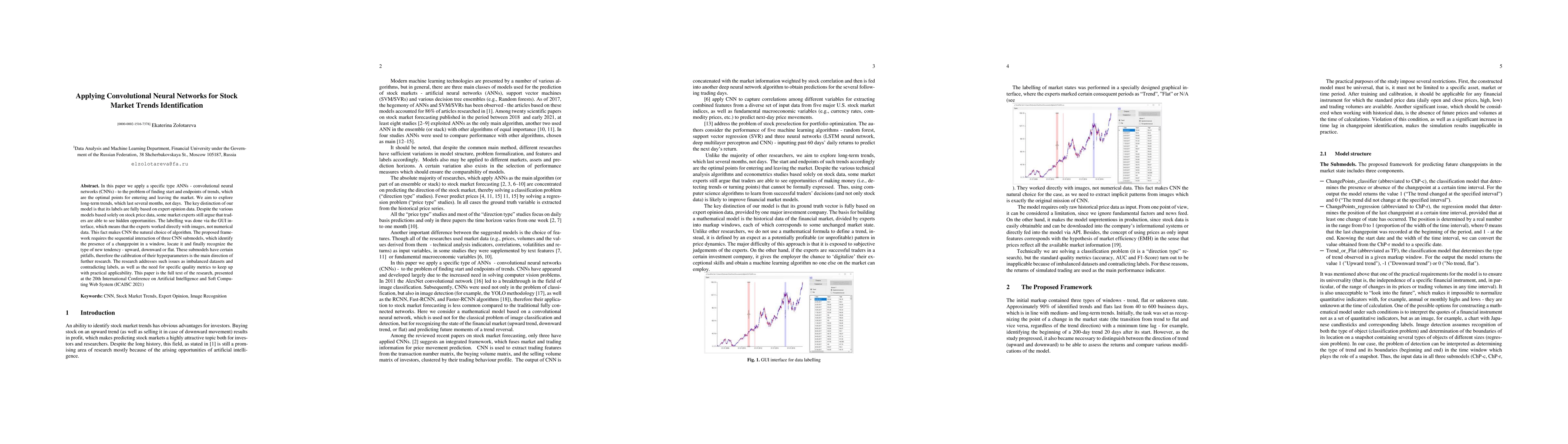

In this paper we apply a specific type ANNs - convolutional neural networks (CNNs) - to the problem of finding start and endpoints of trends, which are the optimal points for entering and leaving the market. We aim to explore long-term trends, which last several months, not days. The key distinction of our model is that its labels are fully based on expert opinion data. Despite the various models based solely on stock price data, some market experts still argue that traders are able to see hidden opportunities. The labelling was done via the GUI interface, which means that the experts worked directly with images, not numerical data. This fact makes CNN the natural choice of algorithm. The proposed framework requires the sequential interaction of three CNN submodels, which identify the presence of a changepoint in a window, locate it and finally recognize the type of new tendency - upward, downward or flat. These submodels have certain pitfalls, therefore the calibration of their hyperparameters is the main direction of further research. The research addresses such issues as imbalanced datasets and contradicting labels, as well as the need for specific quality metrics to keep up with practical applicability. This paper is the full text of the research, presented at the 20th International Conference on Artificial Intelligence and Soft Computing Web System (ICAISC 2021)

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersStock Price Prediction using Multi-Faceted Information based on Deep Recurrent Neural Networks

Mohammad Manthouri, Lida Shahbandari, Elahe Moradi

| Title | Authors | Year | Actions |

|---|

Comments (0)