Summary

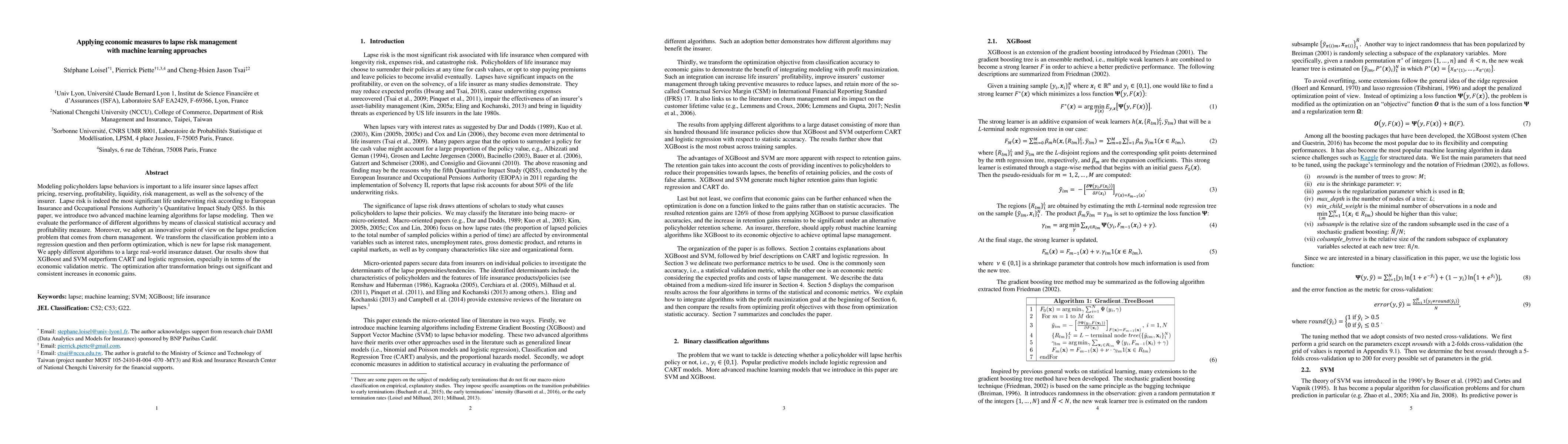

Modeling policyholders lapse behaviors is important to a life insurer since lapses affect pricing, reserving, profitability, liquidity, risk management, as well as the solvency of the insurer. Lapse risk is indeed the most significant life underwriting risk according to European Insurance and Occupational Pensions Authority's Quantitative Impact Study QIS5. In this paper, we introduce two advanced machine learning algorithms for lapse modeling. Then we evaluate the performance of different algorithms by means of classical statistical accuracy and profitability measure. Moreover, we adopt an innovative point of view on the lapse prediction problem that comes from churn management. We transform the classification problem into a regression question and then perform optimization, which is new for lapse risk management. We apply different algorithms to a large real-world insurance dataset. Our results show that XGBoost and SVM outperform CART and logistic regression, especially in terms of the economic validation metric. The optimization after transformation brings out significant and consistent increases in economic gains.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersMomentary dietary lapse prediction for obesity management: Developing the Eating Behaviour Lapse Inventory Survey Singapore (eBLISS) and a machine learning lapse prediction model.

Wang, J, Chew, H S J, Shridhar, M et al.

Diabetes Prediction and Management Using Machine Learning Approaches

Mohammad Subhi Al-Batah, Muhyeeddin Alqaraleh, Mowafaq Salem Alzboon

| Title | Authors | Year | Actions |

|---|

Comments (0)