Authors

Summary

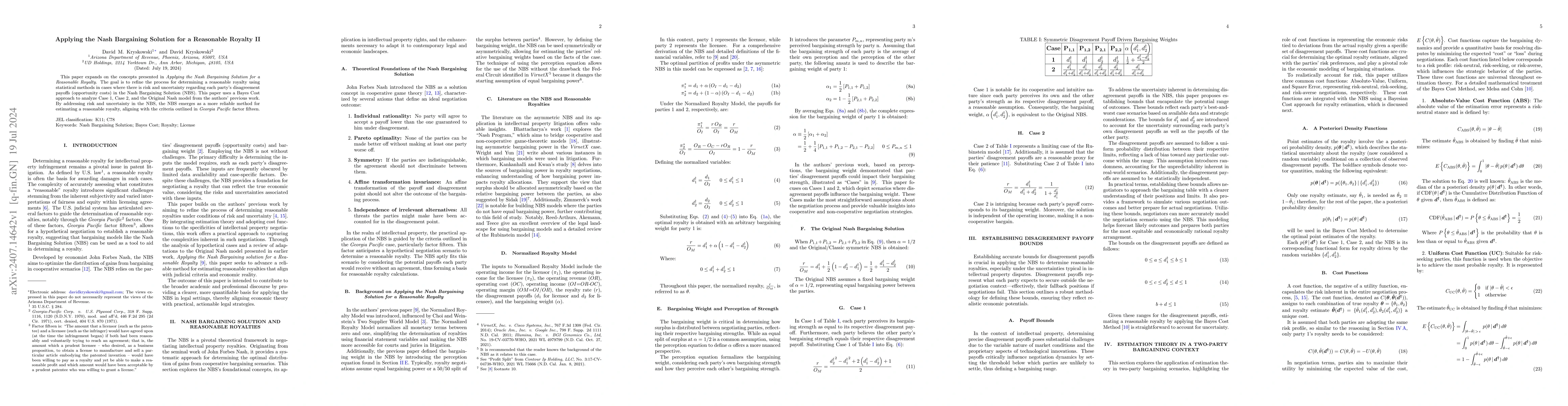

This paper expands on the concepts presented in Applying the Nash Bargaining Solution for a Reasonable Royalty ( arXiv:2005.10158 ). The goal is to refine the process for determining a reasonable royalty using statistical methods in cases where there is risk and uncertainty regarding each party's disagreement payoffs (opportunity costs) in the Nash Bargaining Solution (NBS). This paper uses a Bayes Cost approach to analyze Case 1, Case 2, and the Original Nash model from the authors' previous work. By addressing risk and uncertainty in the NBS, the NBS emerges as a more reliable method for estimating a reasonable royalty, aligning with the criteria outlined in Georgia Pacific factor fifteen.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersNo citations found for this paper.

Comments (0)