Summary

In this note we apply the recently established Wiener-Hopf Monte Carlo (WHMC) simulation technique for Levy processes from Kuznetsov et al. [17] to path functionals, in particular first passage times, overshoots, undershoots and the last maximum before the passage time. Such functionals have many applications, for instance in finance (the pricing of exotic options in a Levy model) and insurance (ruin time, debt at ruin and related quantities for a Levy insurance risk process). The technique works for any Levy process whose running infimum and supremum evaluated at an independent exponential time allows sampling from. This includes classic examples such as stable processes, subclasses of spectrally one sided Levy processes and large new families such as meromorphic Levy processes. Finally we present some examples. A particular aspect that is illustrated is that the WHMC simulation technique performs much better at approximating first passage times than a `plain' Monte Carlo simulation technique based on sampling increments of the Levy process.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

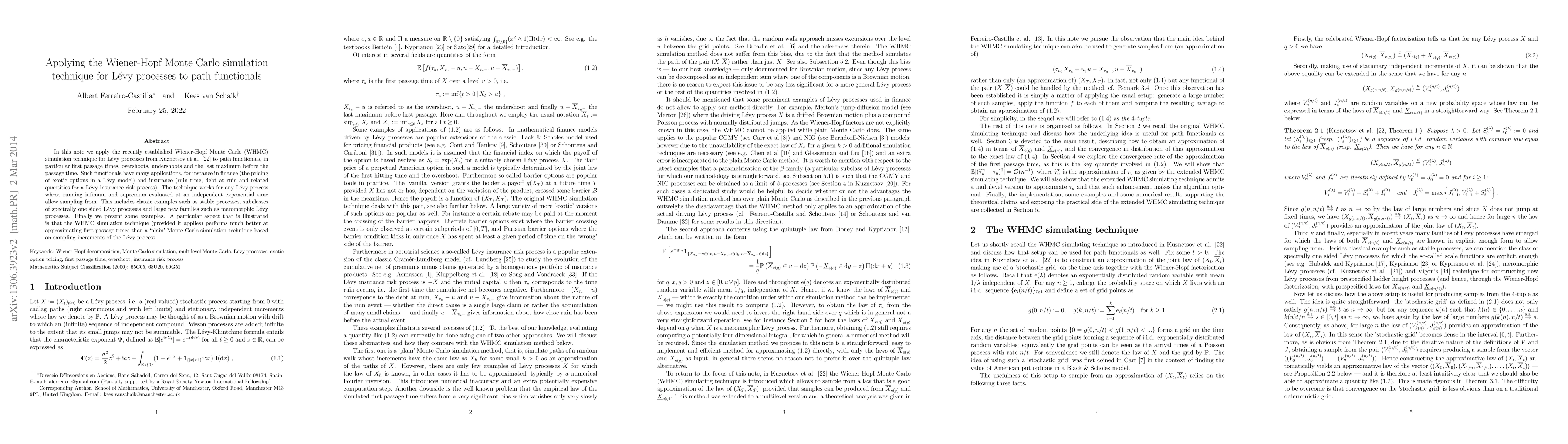

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)