Summary

Credit card fraud is an ongoing problem for almost all industries in the world, and it raises millions of dollars to the global economy each year. Therefore, there is a number of research either completed or proceeding in order to detect these kinds of frauds in the industry. These researches generally use rule-based or novel artificial intelligence approaches to find eligible solutions. The ultimate goal of this paper is to summarize state-of-the-art approaches to fraud detection using artificial intelligence and machine learning techniques. While summarizing, we will categorize the common problems such as imbalanced dataset, real time working scenarios, and feature engineering challenges that almost all research works encounter, and identify general approaches to solve them. The imbalanced dataset problem occurs because the number of legitimate transactions is much higher than the fraudulent ones whereas applying the right feature engineering is substantial as the features obtained from the industries are limited, and applying feature engineering methods and reforming the dataset is crucial. Also, adapting the detection system to real time scenarios is a challenge since the number of credit card transactions in a limited time period is very high. In addition, we will discuss how evaluation metrics and machine learning methods differentiate among each research.

AI Key Findings

Generated Sep 07, 2025

Methodology

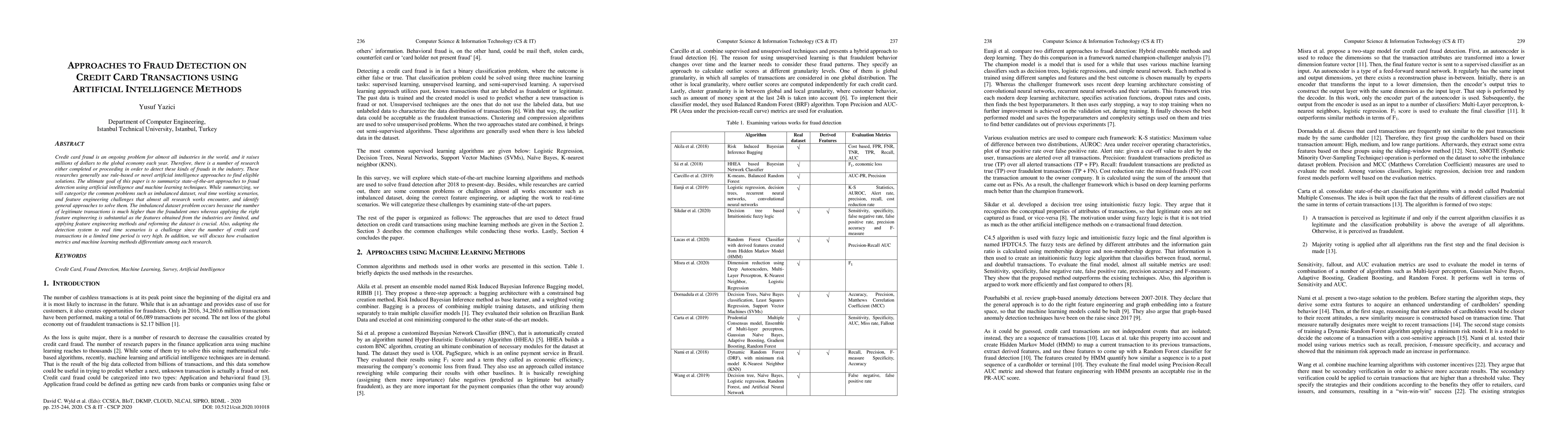

This paper summarizes state-of-the-art approaches to fraud detection using AI and machine learning techniques, categorizing common problems like imbalanced datasets, real-time working scenarios, and feature engineering challenges. It compares hybrid ensemble methods and deep learning through champion-challenger analysis, evaluating various metrics such as K-S statistics, AUROC, alert rate, precision, recall, and cost reduction rate.

Key Results

- Deep learning-based challenger framework outperforms the traditional hybrid ensemble champion framework in fraud detection.

- Intuitionistic fuzzy logic-based decision tree (IFDTC4.5) model shows superior performance compared to existing techniques in fraud detection.

- Graph-based anomaly detection techniques have seen a rise since 2017, offering effective methods for handling credit card fraud detection.

- A two-stage model using autoencoder for dimensionality reduction followed by a supervised classifier improves fraud detection performance.

- A two-stage solution incorporating extra features and a cost-sensitive Dynamic Random Forest algorithm enhances fraud detection accuracy.

Significance

This research is important as it provides a comprehensive overview of AI and machine learning methods for credit card fraud detection, highlighting their effectiveness and challenges. It can guide future research and practical implementations in the financial sector to combat fraud more efficiently.

Technical Contribution

The paper presents champion-challenger analysis for comparing hybrid ensemble methods and deep learning in fraud detection, alongside various feature engineering and real-time working scenario approaches.

Novelty

The research distinguishes itself by categorizing common challenges in fraud detection, comparing different AI methods, and evaluating their performance using various metrics, providing a comprehensive summary of the state-of-the-art in this domain.

Limitations

- Most research still favors offline detection mechanisms rather than real-time solutions.

- The number of studies addressing real-time fraud detection remains relatively low.

Future Work

- Develop more efficient real-time fraud detection systems combining advanced machine learning methods with sufficient feature engineering.

- Explore hybrid models that integrate deep learning with other AI techniques for improved fraud detection performance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersCredit Card Fraud Detection: A Deep Learning Approach

Sourav Verma, Joydip Dhar

| Title | Authors | Year | Actions |

|---|

Comments (0)