Authors

Summary

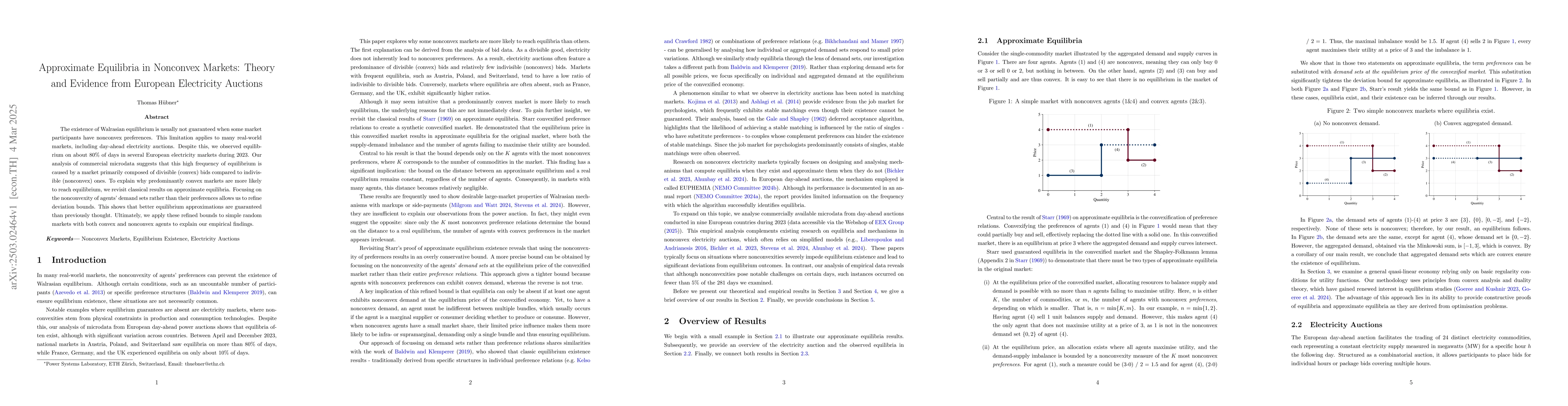

The existence of Walrasian equilibrium is usually not guaranteed when some market participants have nonconvex preferences. This limitation applies to many real-world markets, including day-ahead electricity auctions. Despite this, we observed equilibrium on about 80% of days in several European electricity markets during 2023. Our analysis of commercial microdata suggests that this high frequency of equilibrium is caused by a market primarily composed of divisible (convex) bids compared to indivisible (nonconvex) ones. To explain why predominantly convex markets are more likely to reach equilibrium, we revisit classical results on approximate equilibria. Focusing on the nonconvexity of agents' demand sets rather than their preferences allows us to refine deviation bounds. This shows that better equilibrium approximations are guaranteed than previously thought. Ultimately, we apply these refined bounds to simple random markets with both convex and nonconvex agents to explain our empirical findings.

AI Key Findings

Generated Jun 10, 2025

Methodology

The research utilized commercial microdata from European electricity auctions, applying theoretical models of approximate equilibria to analyze market composition and equilibrium frequency.

Key Results

- Approximately 80% of days in several European electricity markets during 2023 observed equilibrium.

- High frequency of equilibrium is attributed to markets predominantly composed of divisible (convex) bids over indivisible (nonconvex) ones.

- Refined deviation bounds for approximate equilibria show better approximations than previously thought when focusing on agents' demand set nonconvexity rather than preferences.

- Empirical findings align with theoretical predictions, explaining why predominantly convex markets are more likely to reach equilibrium.

Significance

This study is significant as it provides insights into the functioning of real-world nonconvex markets, specifically day-ahead electricity auctions, and offers a theoretical framework to understand and predict equilibrium frequencies.

Technical Contribution

The paper refines the understanding of approximate equilibria in nonconvex markets by focusing on demand set nonconvexity and providing improved deviation bounds.

Novelty

The research distinguishes itself by emphasizing the role of market composition, specifically the prevalence of convex bids, in explaining the high frequency of equilibrium in European electricity auctions, offering a novel perspective on market equilibrium in nonconvex settings.

Limitations

- The analysis is based on European electricity auction data, which may not be universally applicable to other markets.

- The study assumes proper utility functions and compact demand sets, which might not always hold in practice.

Future Work

- Further investigation into the dynamics of equilibrium in markets with varying degrees of nonconvexity.

- Exploration of other market structures and their impact on equilibrium frequency and quality.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersDefault Supply Auctions in Electricity Markets: Challenges and Proposals

Juan Ignacio Peña, Rosa Rodriguez

A fundamental Game Theoretic model and approximate global Nash Equilibria computation for European Spot Power Markets

Ioan Alexandru Puiu, Raphael Andreas Hauser

No citations found for this paper.

Comments (0)