Authors

Summary

Pervasive cross-section dependence is increasingly recognized as a characteristic of economic data and the approximate factor model provides a useful framework for analysis. Assuming a strong factor structure where $\Lop\Lo/N^\alpha$ is positive definite in the limit when $\alpha=1$, early work established convergence of the principal component estimates of the factors and loadings up to a rotation matrix. This paper shows that the estimates are still consistent and asymptotically normal when $\alpha\in(0,1]$ albeit at slower rates and under additional assumptions on the sample size. The results hold whether $\alpha$ is constant or varies across factor loadings. The framework developed for heterogeneous loadings and the simplified proofs that can be also used in strong factor analysis are of independent interest.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

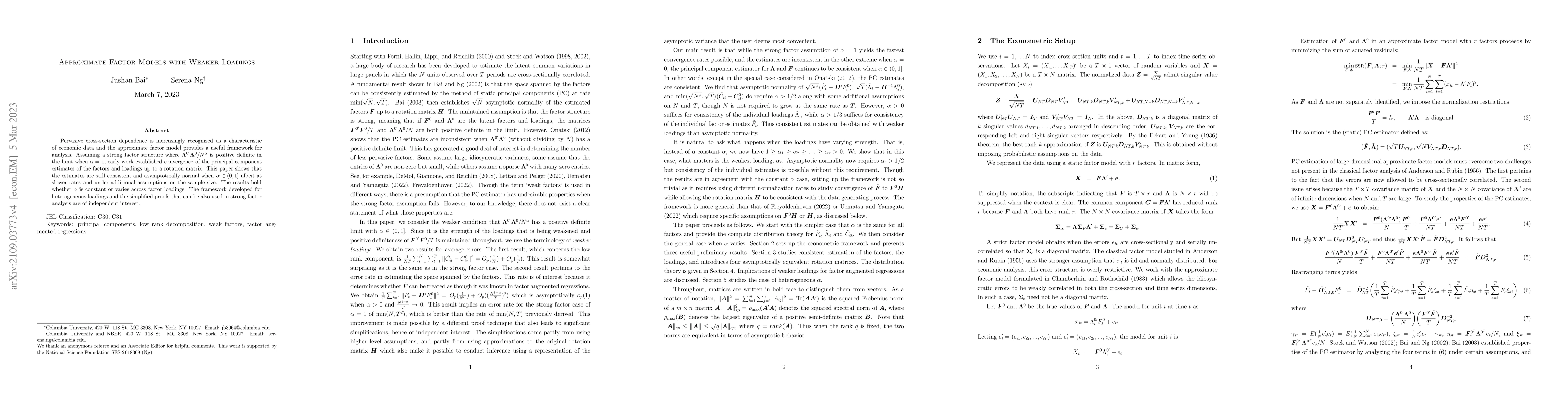

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersNew Tests of Equal Forecast Accuracy for Factor-Augmented Regressions with Weaker Loadings

Luca Margaritella, Ovidijus Stauskas

Diffusion index forecasts under weaker loadings: PCA, ridge regression, and random projections

Tom Boot, Bart Keijsers

| Title | Authors | Year | Actions |

|---|

Comments (0)