Summary

This paper studies a sequential decision problem where payoff distributions are known and where the riskiness of payoffs matters. Equivalently, it studies sequential choice from a repeated set of independent lotteries. The decision-maker is assumed to pursue strategies that are approximately optimal for large horizons. By exploiting the tractability afforded by asymptotics, conditions are derived characterizing when specialization in one action or lottery throughout is asymptotically optimal and when optimality requires intertemporal diversification. The key is the constancy or variability of risk attitude. The main technical tool is a new central limit theorem.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

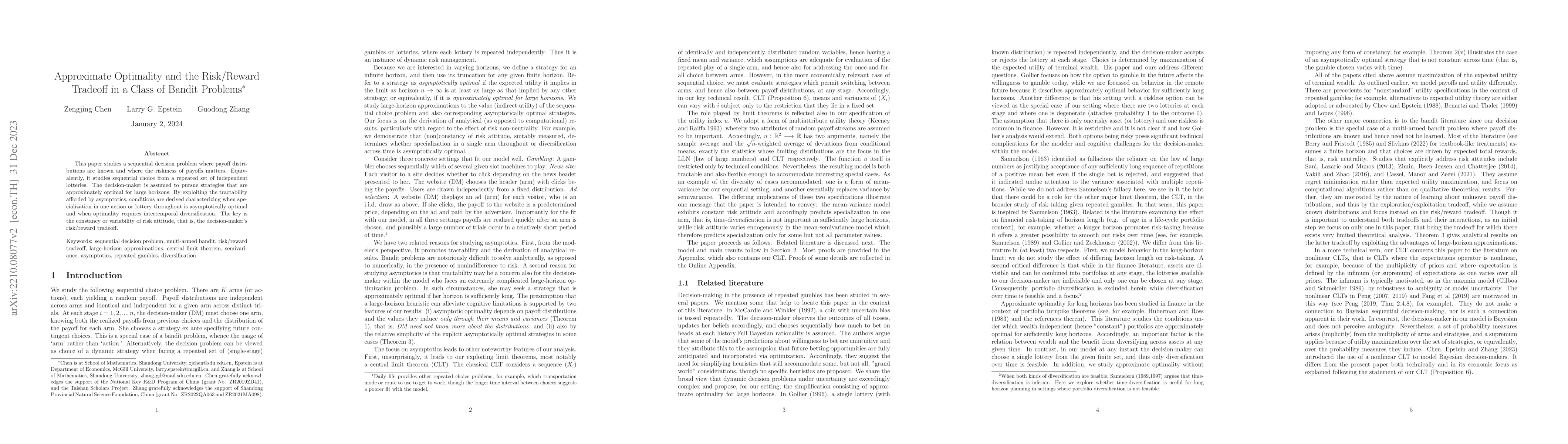

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersUnified theory of upper confidence bound policies for bandit problems targeting total reward, maximal reward, and more

Hiroshi Ohno, Nobuaki Kikkawa

An exact bandit model for the risk-volatility tradeoff

Max-Olivier Hongler, Renaud Rivier

| Title | Authors | Year | Actions |

|---|

Comments (0)