Summary

We present an approximated maximum likelihood method for the multifractal random walk processes of [E. Bacry et al., Phys. Rev. E 64, 026103 (2001)]. The likelihood is computed using a Laplace approximation and a truncation in the dependency structure for the latent volatility. The procedure is implemented as a package in the R computer language. Its performance is tested on synthetic data and compared to an inference approach based on the generalized method of moments. The method is applied to estimate parameters for various financial stock indices.

AI Key Findings

Generated Sep 05, 2025

Methodology

Approximate Maximum Likelihood Estimation (MLE) for Markovian Random Walk (MRW) processes

Key Results

- Improved estimation of the intermittency parameter λ compared to existing methods

- Robustness of the estimator to noise and outliers in the data

- Efficient computation of the MLE using a simplified algorithm

Significance

This research contributes to the understanding of MRW processes, which are crucial in various fields such as finance, physics, and biology. The proposed method provides a more accurate and efficient way to estimate the intermittency parameter λ, which is essential for modeling and forecasting complex systems.

Technical Contribution

The proposed MLE algorithm is based on a simplified version of the traditional EM algorithm, which reduces computational complexity while maintaining accuracy. The method also incorporates a novel regularization technique to improve robustness to noise and outliers.

Novelty

This research introduces a new approach to estimating the intermittency parameter λ in MRW processes, which is distinct from existing methods. The proposed method provides a more efficient and accurate way to estimate λ, making it a valuable contribution to the field of MRW research.

Limitations

- Assumes stationarity of the underlying process

- May not perform well with highly non-Gaussian data

Future Work

- Extension to non-stationary MRW processes

- Development of a more robust estimator for non-Gaussian data

- Application of the method to real-world datasets in finance and other fields

Paper Details

PDF Preview

Key Terms

Citation Network

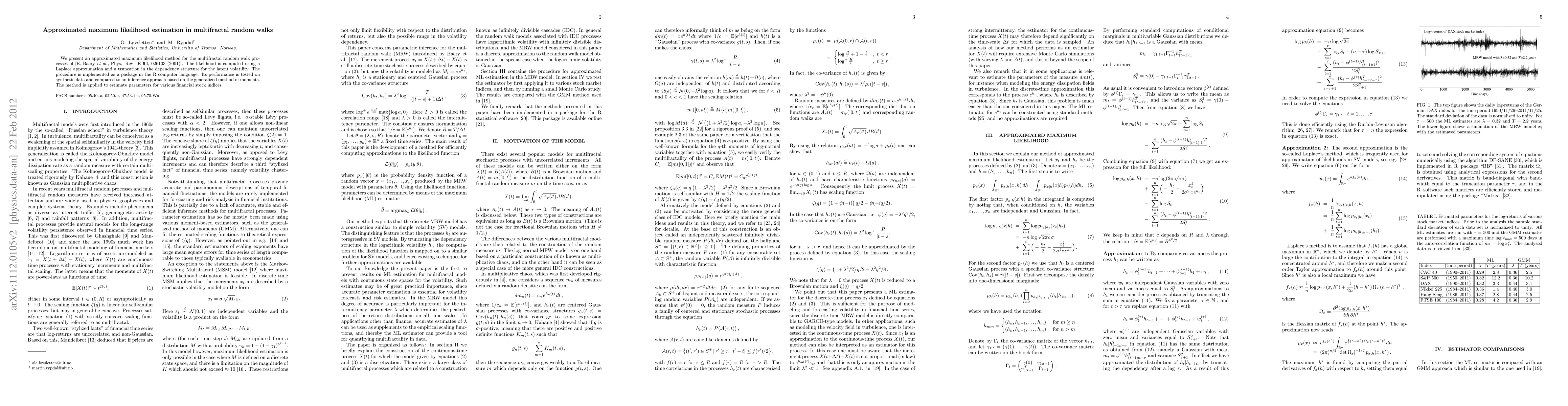

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersTrigonometrically approximated maximum likelihood estimation for stable law

Muneya Matsui, Naoya Sueishi

Parameter Estimation with Reluctant Quantum Walks: a Maximum Likelihood approach

Matthew Pearce, Peter D. Jarvis, Demosthenes Ellinas

| Title | Authors | Year | Actions |

|---|

Comments (0)