Summary

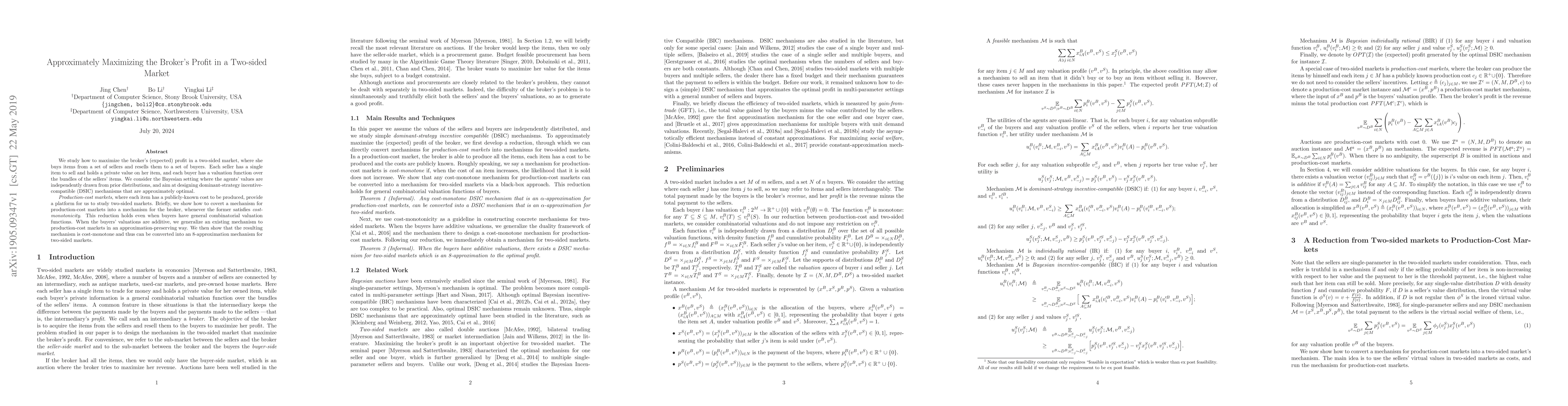

We study how to maximize the broker's (expected) profit in a two-sided market, where she buys items from a set of sellers and resells them to a set of buyers. Each seller has a single item to sell and holds a private value on her item, and each buyer has a valuation function over the bundles of the sellers' items. We consider the Bayesian setting where the agents' values are independently drawn from prior distributions, and aim at designing dominant-strategy incentive-compatible (DSIC) mechanisms that are approximately optimal. Production-cost markets, where each item has a publicly-known cost to be produced, provide a platform for us to study two-sided markets. Briefly, we show how to covert a mechanism for production-cost markets into a mechanism for the broker, whenever the former satisfies cost-monotonicity. This reduction holds even when buyers have general combinatorial valuation functions. When the buyers' valuations are additive, we generalize an existing mechanism to production-cost markets in an approximation-preserving way. We then show that the resulting mechanism is cost-monotone and thus can be converted into an 8-approximation mechanism for two-sided markets.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersRandomization Inference in Two-Sided Market Experiments

Azeem M. Shaikh, Jizhou Liu, Panos Toulis

Maximizing Nash Social Welfare under Two-Sided Preferences

Rohit Vaish, Pallavi Jain

| Title | Authors | Year | Actions |

|---|

Comments (0)