Authors

Summary

Two sellers compete to sell identical products to a single buyer. Each seller chooses an arbitrary mechanism, possibly involving lotteries, to sell their product. The utility-maximizing buyer can choose to participate in one or both mechanisms, resolving them in either order. Given a common prior over buyer values, how should the sellers design their mechanisms to maximize their respective revenues? We first consider a Stackelberg setting where one seller (Alice) commits to her mechanism and the other seller (Bob) best-responds. We show how to construct a simple and approximately-optimal single-lottery mechanism for Alice that guarantees her a quarter of the optimal monopolist's revenue, for any regular distribution. Along the way we prove a structural result: for any single-lottery mechanism of Alice, there will always be a best response mechanism for Bob consisting of a single take-it-or-leave-it price. We also show that no mechanism (single-lottery or otherwise) can guarantee Alice more than a 1/e fraction of the monopolist revenue. Finally, we show that our approximation result does not extend to Nash equilibrium: there exist instances in which a monopolist could extract full surplus, but neither competing seller obtains positive revenue at any equilibrium choice of mechanisms.

AI Key Findings

Generated Jun 07, 2025

Methodology

The research employs a Stackelberg game setting where one seller (Alice) commits to a single-lottery mechanism, and the other seller (Bob) best-responds with a single take-it-or-leave-it price mechanism. This approach is used to analyze and design mechanisms for maximizing revenues under competition.

Key Results

- A simple and approximately-optimal single-lottery mechanism for Alice is constructed, guaranteeing her a quarter of the optimal monopolist's revenue for any regular distribution of buyer values.

- A structural result is proven: for any single-lottery mechanism of Alice, Bob's best response will always consist of a single take-it-or-leave-it price.

- No mechanism can guarantee Alice more than a 1/e fraction of the monopolist revenue.

- The approximation result does not extend to Nash equilibrium; instances exist where neither competing seller obtains positive revenue at equilibrium.

Significance

This research is important as it provides insights into optimal mechanism design for competing sellers, helping them maximize revenues in competitive environments, and understanding the limitations of their strategies.

Technical Contribution

The paper presents a structural result linking any single-lottery mechanism chosen by Alice to a corresponding best-response mechanism for Bob as a single take-it-or-leave-it price, along with revenue bounds for sellers in a competitive setting.

Novelty

The work introduces a novel approach to approximately optimal mechanism design for competing sellers, providing bounds and structural insights not previously established in the literature.

Limitations

- The approximation result for Alice's revenue does not hold in Nash equilibrium.

- The analysis is limited to a Stackelberg setting with two sellers and does not generalize to more complex multi-seller scenarios immediately.

Future Work

- Investigate the extension of these results to more than two competing sellers.

- Explore the implications of these findings for more complex mechanism designs and auction formats.

Paper Details

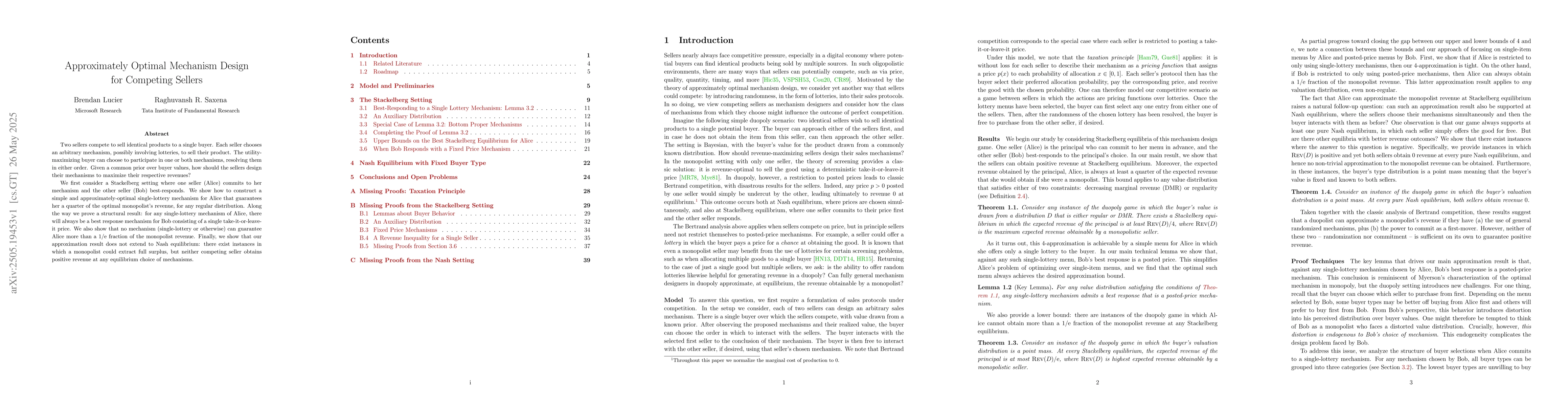

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersRefined Mechanism Design for Approximately Structured Priors via Active Regression

Marios Mertzanidis, Alexandros Psomas, Paritosh Verma et al.

No citations found for this paper.

Comments (0)