Summary

Lognormal random variables appear naturally in many engineering disciplines, including wireless communications, reliability theory, and finance. So, too, does the sum of (correlated) lognormal random variables. Unfortunately, no closed form probability distribution exists for such a sum, and it requires approximation. Some approximation methods date back over 80 years and most take one of two approaches, either: 1) an approximate probability distribution is derived mathematically, or 2) the sum is approximated by a single lognormal random variable. In this research, we take the latter approach and review a fairly recent approximation procedure proposed by Mehta, Wu, Molisch, and Zhang (2007), then implement it using C++. The result is applied to a discrete time model commonly encountered within the field of financial economics.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

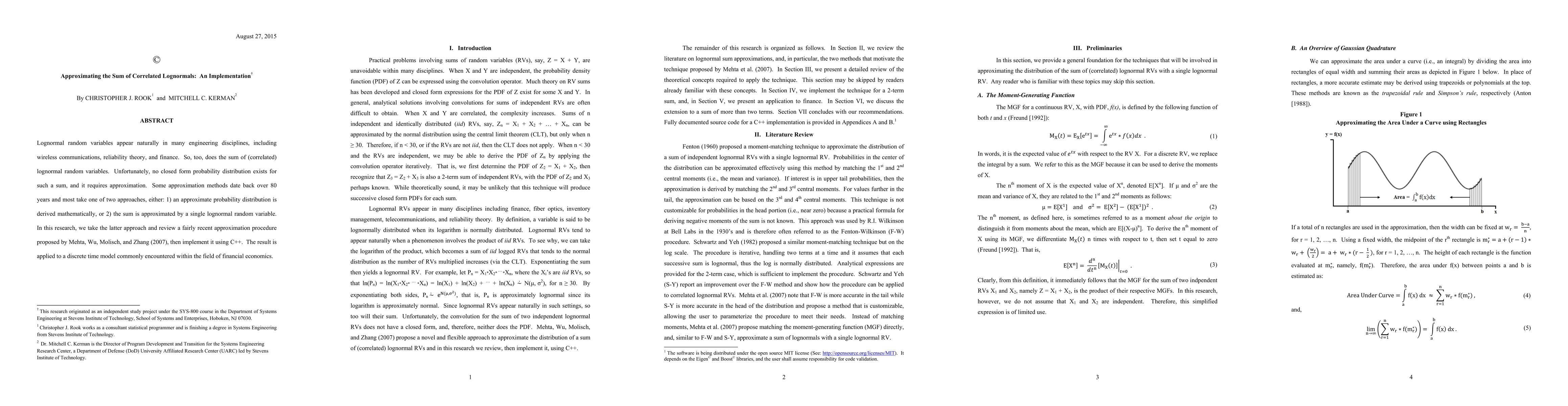

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)