Summary

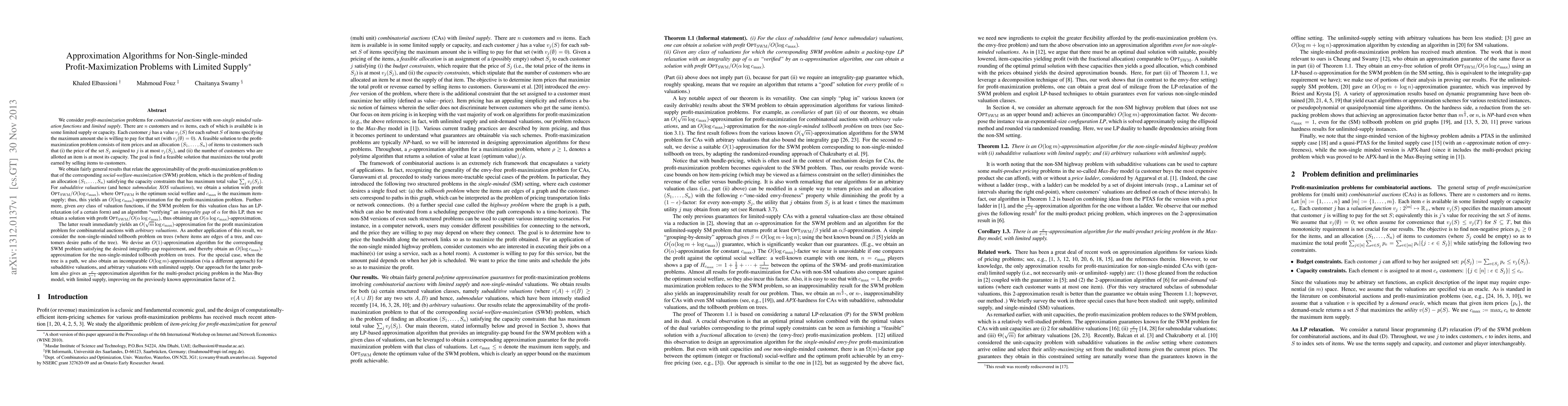

We consider {\em profit-maximization} problems for {\em combinatorial auctions} with {\em non-single minded valuation functions} and {\em limited supply}. We obtain fairly general results that relate the approximability of the profit-maximization problem to that of the corresponding {\em social-welfare-maximization} (SWM) problem, which is the problem of finding an allocation $(S_1,\ldots,S_n)$ satisfying the capacity constraints that has maximum total value $\sum_j v_j(S_j)$. For {\em subadditive valuations} (and hence {\em submodular, XOS valuations}), we obtain a solution with profit $\OPT_\swm/O(\log c_{\max})$, where $\OPT_\swm$ is the optimum social welfare and $c_{\max}$ is the maximum item-supply; thus, this yields an $O(\log c_{\max})$-approximation for the profit-maximization problem. Furthermore, given {\em any} class of valuation functions, if the SWM problem for this valuation class has an LP-relaxation (of a certain form) and an algorithm "verifying" an {\em integrality gap} of $\al$ for this LP, then we obtain a solution with profit $\OPT_\swm/O(\al\log c_{\max})$, thus obtaining an $O(\al\log c_{\max})$-approximation. For the special case, when the tree is a path, we also obtain an incomparable $O(\log m)$-approximation (via a different approach) for subadditive valuations, and arbitrary valuations with unlimited supply. Our approach for the latter problem also gives an $\frac{e}{e-1}$-approximation algorithm for the multi-product pricing problem in the Max-Buy model, with limited supply, improving on the previously known approximation factor of 2.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersProfit Maximization in Social Networks and Non-monotone DR-submodular Maximization

Shuyang Gu, Jun Huang, Weili Wu et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)