Authors

Summary

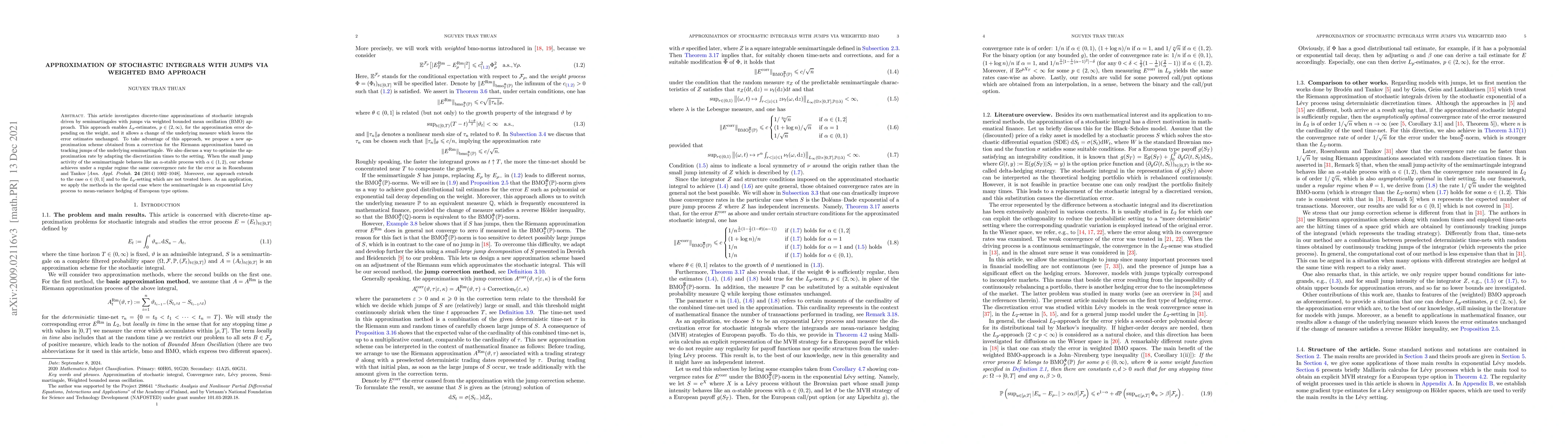

This article investigates discrete-time approximations of stochastic integrals driven by semimartingales with jumps via weighted bounded mean oscillation (BMO) approach. This approach enables $L_p$-estimates, $p \in (2, \infty)$, for the approximation error depending on the weight, and it allows a change of the underlying measure which leaves the error estimates unchanged. To take advantage of this approach, we propose a new approximation scheme obtained from a correction for the Riemann approximation based on tracking jumps of the underlying semimartingale. We also discuss a way to optimize the approximation rate by adapting the discretization times to the setting. When the small jump activity of the semimartingale behaves like an $\alpha$-stable process with $\alpha \in (1, 2)$, our scheme achieves under a regular regime the same convergence rate for the error as in Rosenbaum and Tankov [\textit{Ann. Appl. Probab.} \textbf{24} (2014) 1002--1048]. Moreover, our approach extends to the case $\alpha \in (0, 1]$ and to the $L_p$-setting which are not treated there. As an application, we apply the methods in the special case where the semimartingale is an exponential L\'evy process to mean-variance hedging of European type options.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)