Authors

Summary

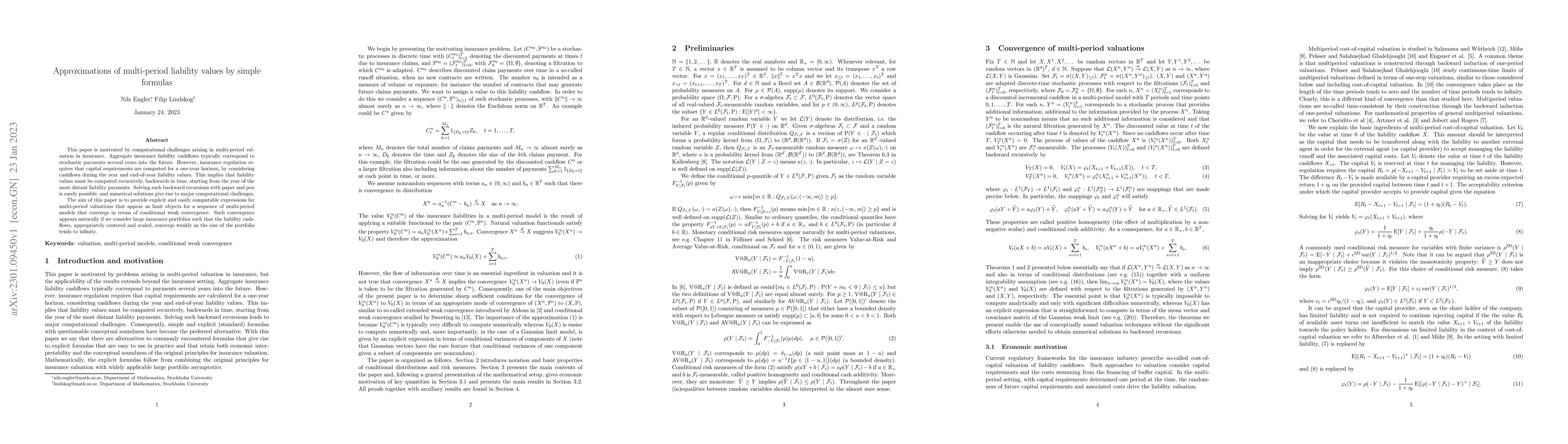

This paper is motivated by computational challenges arising in multi-period valuation in insurance. Aggregate insurance liability cashflows typically correspond to stochastic payments several years into the future. However, insurance regulation requires that capital requirements are computed for a one-year horizon, by considering cashflows during the year and end-of-year liability values. This implies that liability values must be computed recursively, backwards in time, starting from the year of the most distant liability payments. Solving such backward recursions with paper and pen is rarely possible, and numerical solutions give rise to major computational challenges. The aim of this paper is to provide explicit and easily computable expressions for multi-period valuations that appear as limit objects for a sequence of multi-period models that converge in terms of conditional weak convergence. Such convergence appears naturally if we consider large insurance portfolios such that the liability cashflows, appropriately centered and scaled, converge weakly as the size of the portfolio tends to infinity.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersNo citations found for this paper.

Comments (0)