Summary

Models which postulate lognormal dynamics for interest rates which are compounded according to market conventions, such as forward LIBOR or forward swap rates, can be constructed initially in a discrete tenor framework. Interpolating interest rates between maturities in the discrete tenor structure is equivalent to extending the model to continuous tenor. The present paper sets forth an alternative way of performing this extension; one which preserves the Markovian properties of the discrete tenor models and guarantees the positivity of all interpolated rates.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

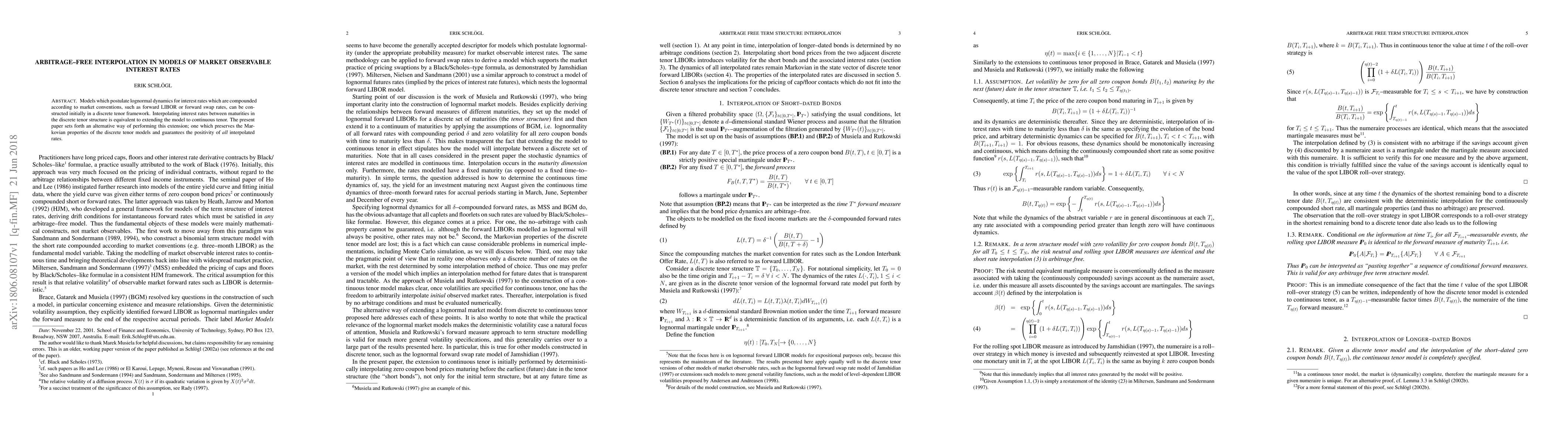

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersOn weak notions of no-arbitrage in a 1D general diffusion market with interest rates

David Criens, Mikhail Urusov, Alexis Anagnostakis

| Title | Authors | Year | Actions |

|---|

Comments (0)