Summary

We study the Fundamental Theorem of Asset Pricing for a general financial market under Knightian Uncertainty. We adopt a functional analytic approach which require neither specific assumptions on the class of priors $\mathcal{P}$ nor on the structure of the state space. Several aspects of modeling under Knightian Uncertainty are considered and analyzed. We show the need for a suitable adaptation of the notion of No Free Lunch with Vanishing Risk and discuss its relation to the choice of an appropriate filtration. In an abstract setup, we show that absence of arbitrage is equivalent to the existence of \emph{approximate} martingale measures sharing the same polar set of $\mathcal{P}$. We then specialize the results to a discrete-time framework in order to obtain true martingale measures.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

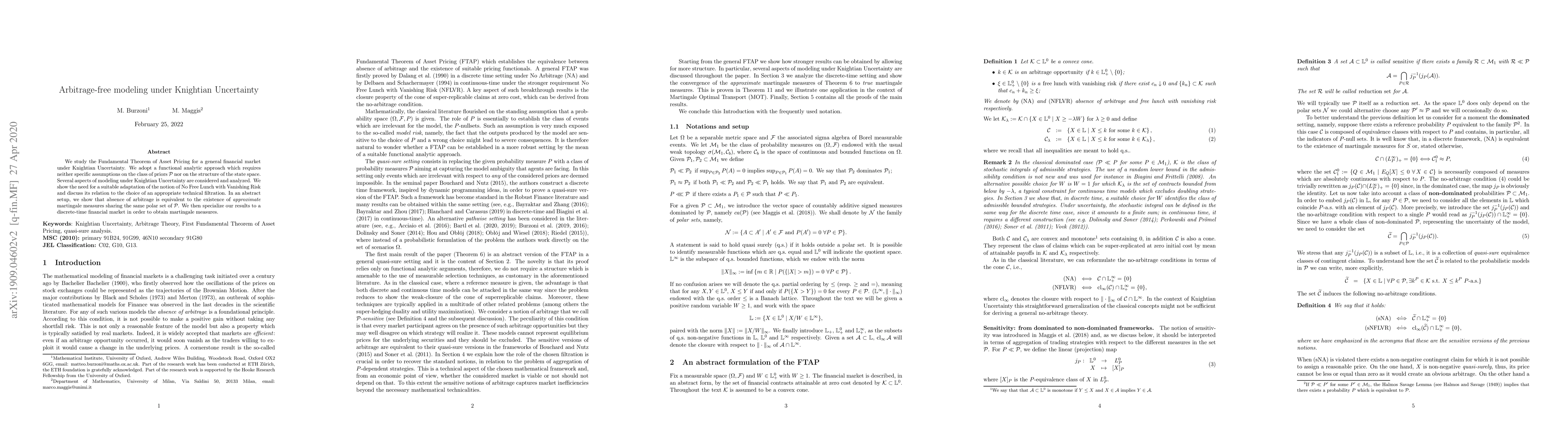

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersResearch on Optimal Control Problem Based on Reinforcement Learning under Knightian Uncertainty

Ziyu Li, Chen Fei, Weiyin Fei

| Title | Authors | Year | Actions |

|---|

Comments (0)