Summary

"Fundamental theorem of asset pricing" roughly states that absence of arbitrage opportunity in a market is equivalent to the existence of a risk-neutral probability. We give a simple counterexample to this oversimplified statement. Prices are given by linear forms which do not always correspond to probabilities. We give examples of such cases. We also show that arbitrage freedom is equivalent to the continuity of the pricing linear form in the relevant topology. Finally we analyze the possible loss of martingality of asset prices with lognormal stochastic volatility. For positive correlation martingality is lost when the financial process is modelled through standard probability theory. We show how to recover martingality using the appropriate mathematical tools.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

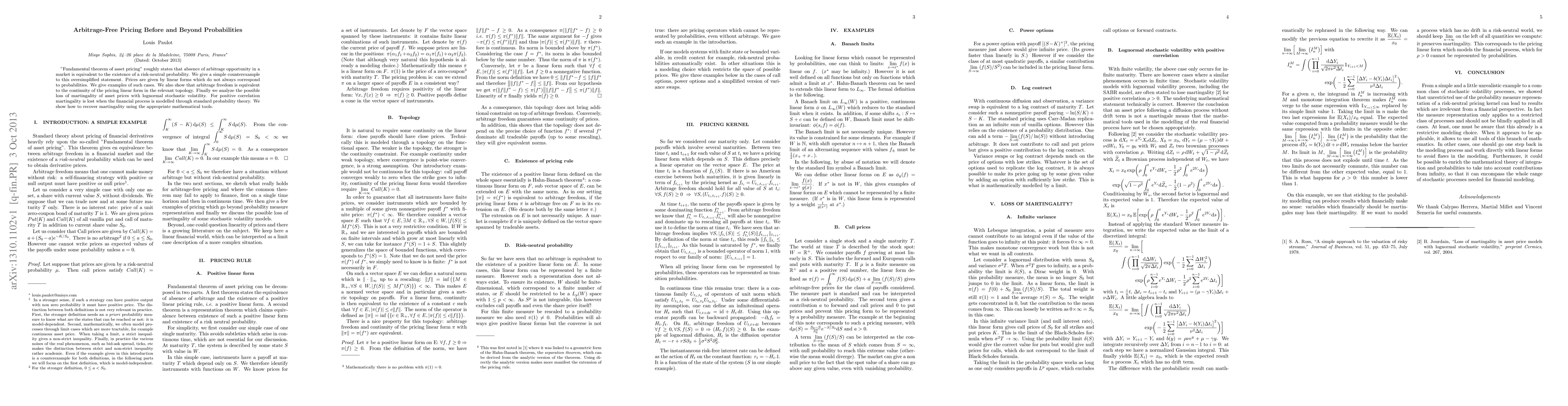

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)