Summary

The objective of this paper is to provide a comprehensive study no-arbitrage pricing of financial derivatives in the presence of funding costs, the counterparty credit risk and market frictions affecting the trading mechanism, such as collateralization and capital requirements. To achieve our goals, we extend in several respects the nonlinear pricing approach developed in El Karoui and Quenez (1997) and El Karoui et al. (1997), which was subsequently continued in Bielecki and Rutkowski (2015).

AI Key Findings

Generated Sep 04, 2025

Methodology

Bergman's model with differential borrowing and lending interest rates

Key Results

- The put option can be replicated without borrowing cash

- The hedger's price of the European put option is given by the Black-Scholes formula

- The model satisfies Assumption 4.4

Significance

This research highlights the importance of considering differential borrowing and lending interest rates in financial models

Technical Contribution

The introduction of differential borrowing and lending interest rates in Bergman's model

Novelty

This work highlights the importance of considering differential interest rates in financial models, which is not typically accounted for in existing literature

Limitations

- The model assumes a constant interest rate for the asset S2

- The model does not account for other sources of risk

Future Work

- Investigating the impact of different interest rate regimes on the put option's replication cost

- Developing a more comprehensive model that incorporates additional sources of risk

Paper Details

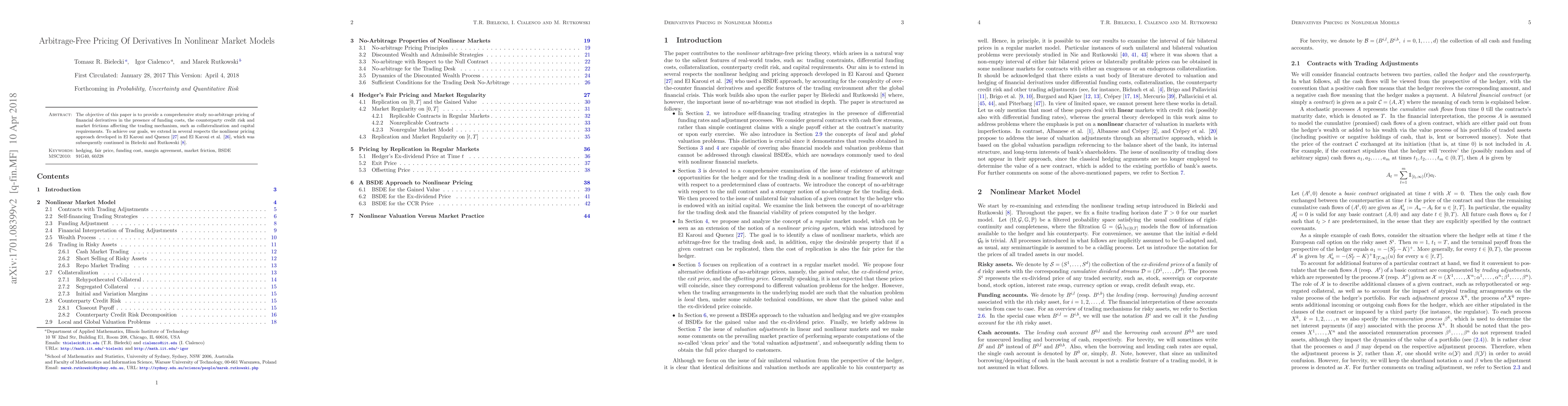

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)