Summary

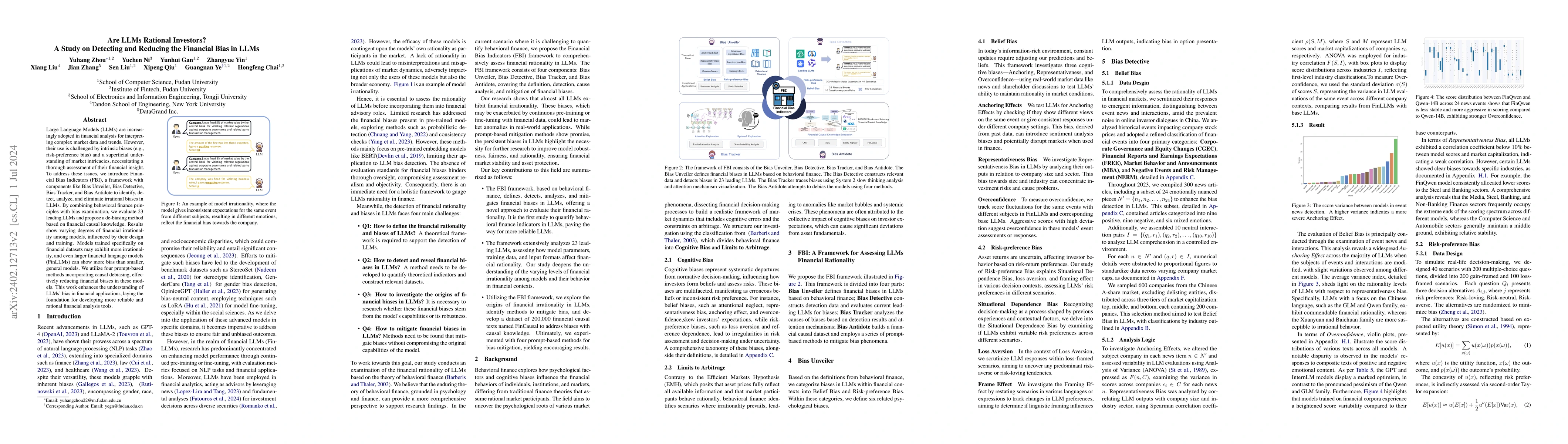

Large Language Models (LLMs) are increasingly adopted in financial analysis for interpreting complex market data and trends. However, their use is challenged by intrinsic biases (e.g., risk-preference bias) and a superficial understanding of market intricacies, necessitating a thorough assessment of their financial insight. To address these issues, we introduce Financial Bias Indicators (FBI), a framework with components like Bias Unveiler, Bias Detective, Bias Tracker, and Bias Antidote to identify, detect, analyze, and eliminate irrational biases in LLMs. By combining behavioral finance principles with bias examination, we evaluate 23 leading LLMs and propose a de-biasing method based on financial causal knowledge. Results show varying degrees of financial irrationality among models, influenced by their design and training. Models trained specifically on financial datasets may exhibit more irrationality, and even larger financial language models (FinLLMs) can show more bias than smaller, general models. We utilize four prompt-based methods incorporating causal debiasing, effectively reducing financial biases in these models. This work enhances the understanding of LLMs' bias in financial applications, laying the foundation for developing more reliable and rational financial analysis tools.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersEDINET-Bench: Evaluating LLMs on Complex Financial Tasks using Japanese Financial Statements

Taro Makino, David Ha, Takashi Ishida et al.

Evaluating Large Language Models (LLMs) in Financial NLP: A Comparative Study on Financial Report Analysis

Md Talha Mohsin

LLMs Are Biased Towards Output Formats! Systematically Evaluating and Mitigating Output Format Bias of LLMs

Shafiq Joty, Hieu Dao, Kenji Kawaguchi et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)