Summary

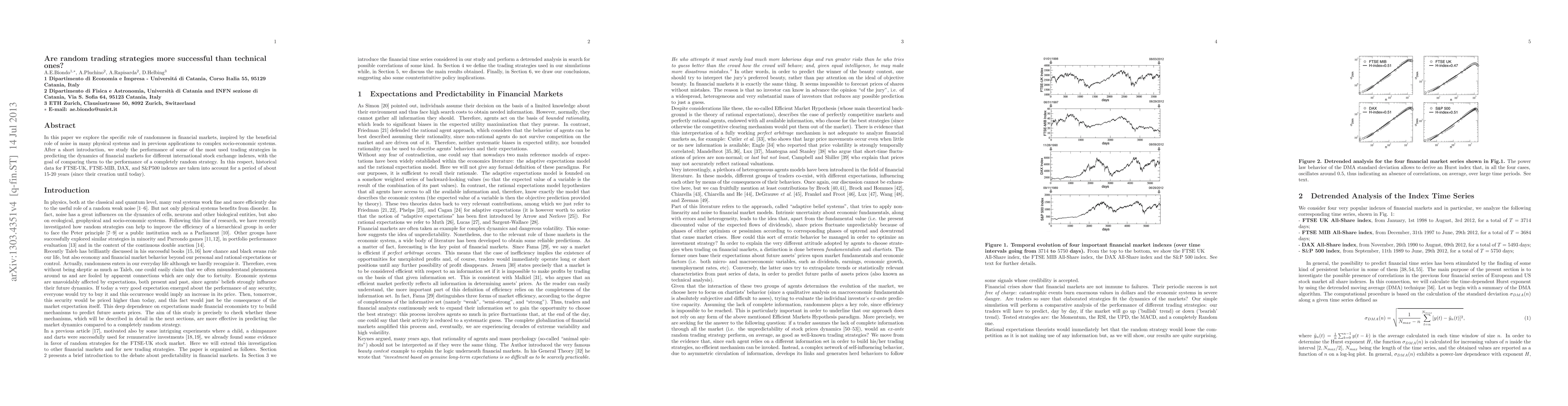

In this paper we explore the specific role of randomness in financial markets, inspired by the beneficial role of noise in many physical systems and in previous applications to complex socio- economic systems. After a short introduction, we study the performance of some of the most used trading strategies in predicting the dynamics of financial markets for different international stock exchange indexes, with the goal of comparing them with the performance of a completely random strategy. In this respect, historical data for FTSE-UK, FTSE-MIB, DAX, and S&P500 indexes are taken into account for a period of about 15-20 years (since their creation until today).

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersQuantum clocks are more precise than classical ones

Mischa P. Woods, Ralph Silva, Renato Renner et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)