Summary

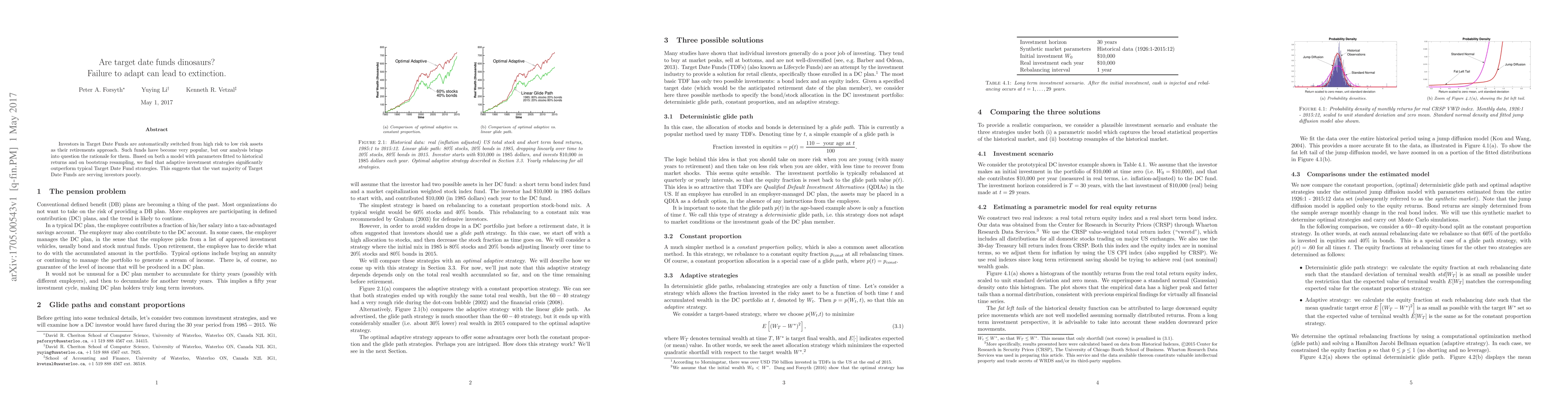

Investors in Target Date Funds are automatically switched from high risk to low risk assets as their retirements approach. Such funds have become very popular, but our analysis brings into question the rationale for them. Based on both a model with parameters fitted to historical returns and on bootstrap resampling, we find that adaptive investment strategies significantly outperform typical Target Date Fund strategies. This suggests that the vast majority of Target Date Funds are serving investors poorly.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersTarget-Date Funds: A State-of-the-Art Review with Policy Applications to Chile's Pension Reform

Fernando Suárez, Omar Larré, José Manuel Peña

Is the Hubble crisis connected with the extinction of dinosaurs?

Leandros Perivolaropoulos

| Title | Authors | Year | Actions |

|---|

Comments (0)