Summary

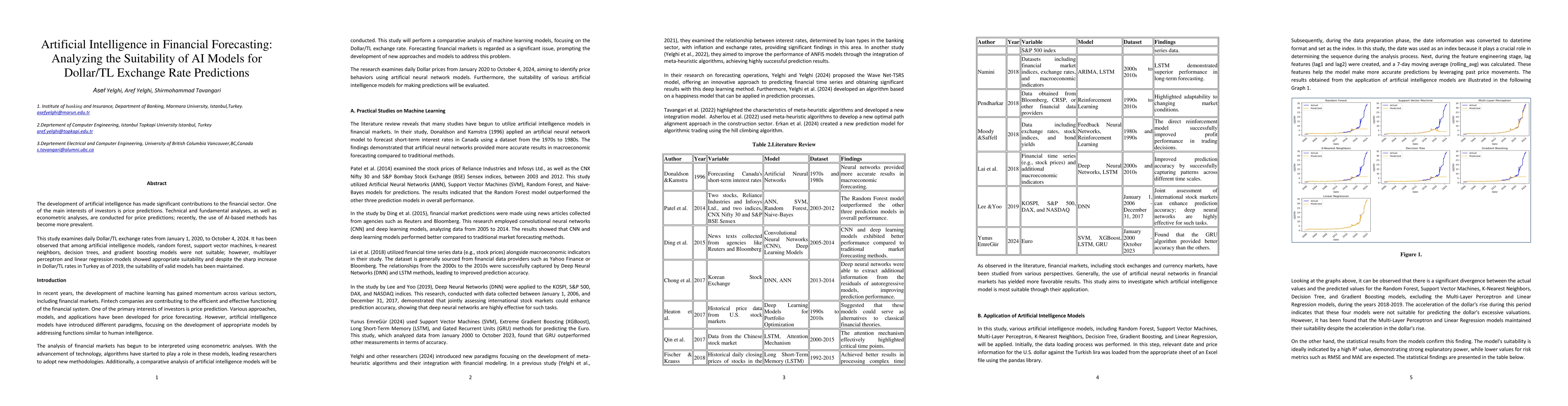

The development of artificial intelligence has made significant contributions to the financial sector. One of the main interests of investors is price predictions. Technical and fundamental analyses, as well as econometric analyses, are conducted for price predictions; recently, the use of AI-based methods has become more prevalent. This study examines daily Dollar/TL exchange rates from January 1, 2020, to October 4, 2024. It has been observed that among artificial intelligence models, random forest, support vector machines, k-nearest neighbors, decision trees, and gradient boosting models were not suitable; however, multilayer perceptron and linear regression models showed appropriate suitability and despite the sharp increase in Dollar/TL rates in Turkey as of 2019, the suitability of valid models has been maintained.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Similar Papers

Found 4 papersNo citations found for this paper.

Comments (0)