Summary

We present a family of submodular valuation classes that generalizes gross substitute. We show that Walrasian equilibrium always exist for one class in this family, and there is a natural ascending auction which finds it. We prove some new structural properties on gross-substitute auctions which, in turn, show that the known ascending auctions for this class (Gul-Stacchetti and Ausbel) are, in fact, identical. We generalize these two auctions, and provide a simple proof that they terminate in a Walrasian equilibrium.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

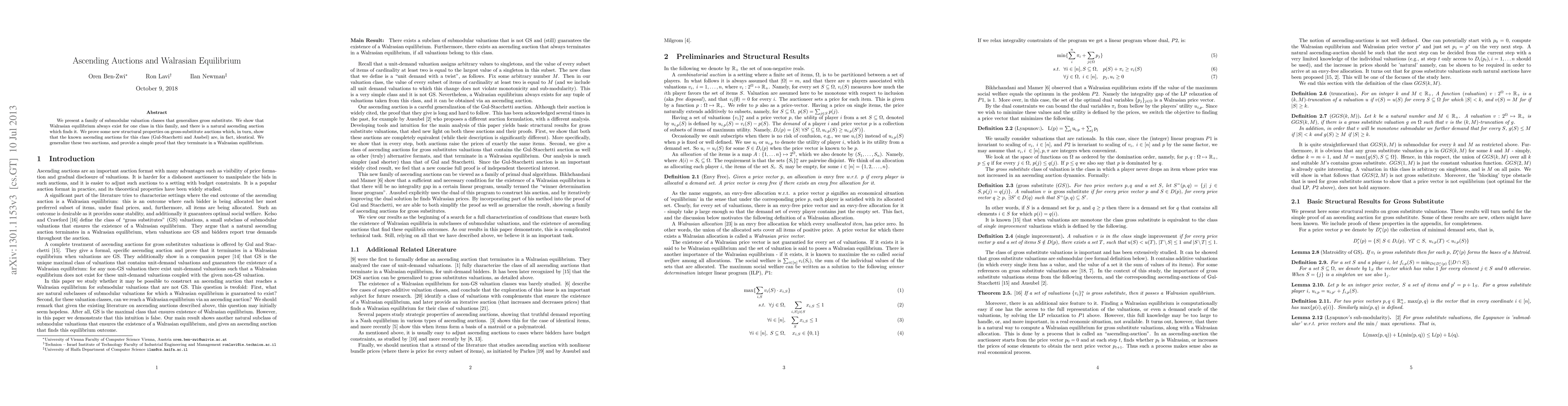

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersA flow-based ascending auction to compute buyer-optimal Walrasian prices

Katharina Eickhoff, S. Thomas McCormick, Britta Peis et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)