Summary

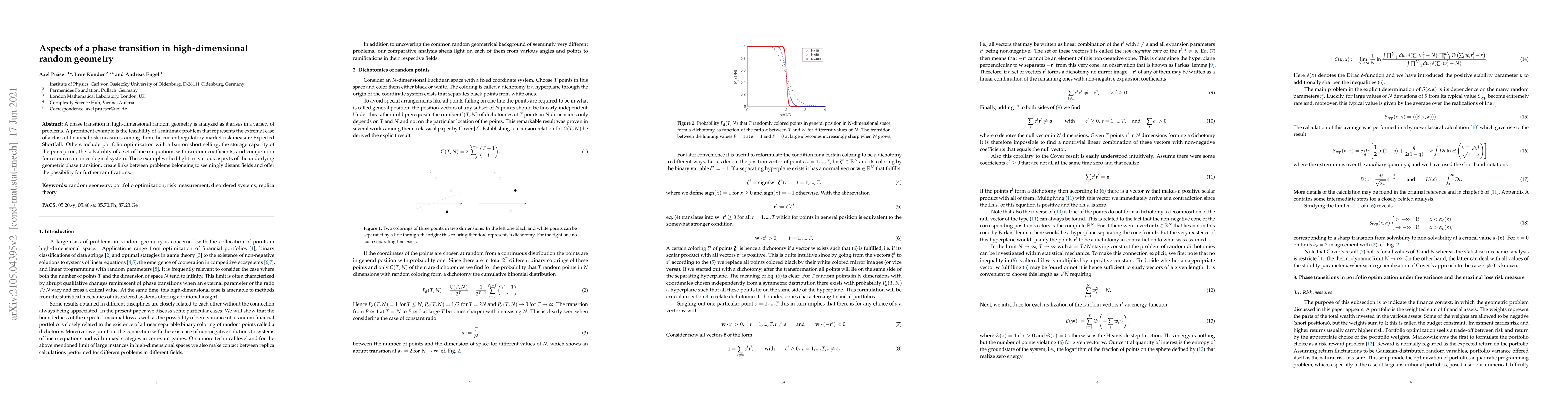

A phase transition in high-dimensional random geometry is analyzed as it arises in a variety of problems. A prominent example is the feasibility of a minimax problem that represents the extremal case of a class of financial risk measures, among them the current regulatory market risk measure Expected Shortfall. Others include portfolio optimization with a ban on short selling, the storage capacity of the perceptron, the solvability of a set of linear equations with random coefficients, and competition for resources in an ecological system. These examples shed light on various aspects of the underlying geometric phase transition, create links between problems belonging to seemingly distant fields and offer the possibility for further ramifications.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersA geometry-induced topological phase transition in random graphs

Marián Boguñá, M. Ángeles Serrano, Jasper van der Kolk

| Title | Authors | Year | Actions |

|---|

Comments (0)