Authors

Summary

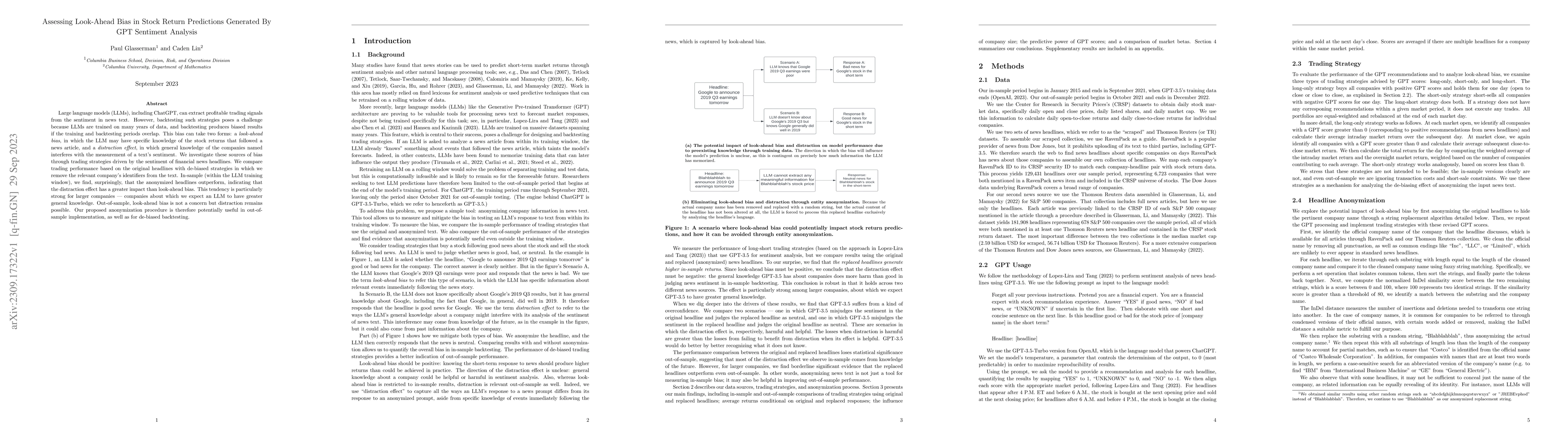

Large language models (LLMs), including ChatGPT, can extract profitable trading signals from the sentiment in news text. However, backtesting such strategies poses a challenge because LLMs are trained on many years of data, and backtesting produces biased results if the training and backtesting periods overlap. This bias can take two forms: a look-ahead bias, in which the LLM may have specific knowledge of the stock returns that followed a news article, and a distraction effect, in which general knowledge of the companies named interferes with the measurement of a text's sentiment. We investigate these sources of bias through trading strategies driven by the sentiment of financial news headlines. We compare trading performance based on the original headlines with de-biased strategies in which we remove the relevant company's identifiers from the text. In-sample (within the LLM training window), we find, surprisingly, that the anonymized headlines outperform, indicating that the distraction effect has a greater impact than look-ahead bias. This tendency is particularly strong for larger companies--companies about which we expect an LLM to have greater general knowledge. Out-of-sample, look-ahead bias is not a concern but distraction remains possible. Our proposed anonymization procedure is therefore potentially useful in out-of-sample implementation, as well as for de-biased backtesting.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersGenerating Empathetic Responses by Looking Ahead the User's Sentiment

Peng Xu, Jamin Shin, Pascale Fung et al.

BERTopic-Driven Stock Market Predictions: Unraveling Sentiment Insights

Enmin Zhu, Jerome Yen

BERT-based Financial Sentiment Index and LSTM-based Stock Return Predictability

Qi Wu, Xin Huang, Yabo Xu et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)