Summary

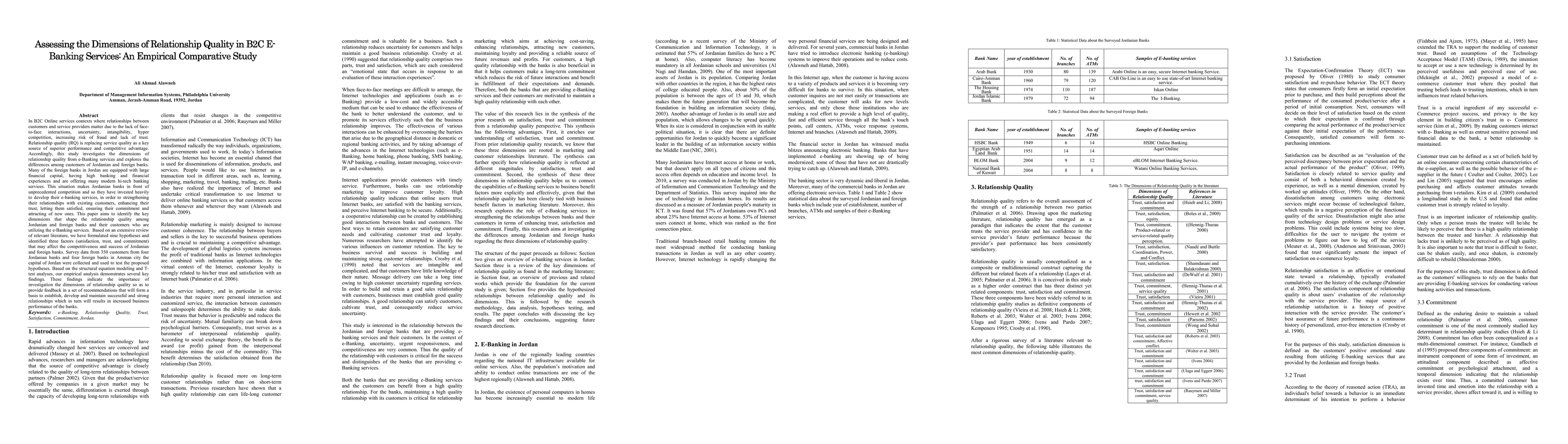

In B2C Online services contexts where relationships between customers and service providers matter due to the lack of faceto- face interactions, uncertainty, intangibility, hyper competition, increasing risk of fraud and lack of trust. Relationship quality (RQ) is replacing service quality as a key source of superior performance and competitive advantage. Accordingly, this study investigates the dimensions of relationship quality from e-Banking services and explores the differences among customers of Jordanian and foreign banks. Many of the foreign banks in Jordan are equipped with large financial capital, having high banking and financial experiences and are offering many modern hi-tech banking services. This situation makes Jordanian banks in front of unprecedented competition and so they have invested heavily to develop their e-banking services, in order to strengthening their relationships with existing customers, enhancing their trust, letting them satisfied, ensuring their commitment and attracting of new ones. This paper aims to identify the key dimensions that shape the relationship quality among Jordanian and foreign banks and their customers who are utilizing the e-Banking services. Based on an extensive review of relevant literature, we have formulated nine hypotheses and identified three factors (satisfaction, trust, and commitment) that may affect the competitiveness and success of Jordanian and foreign banks. Survey data from 350 customers from four Jordanian banks and four foreign banks in Amman city the capital of Jordan were collected and used to test the proposed hypotheses. Based on the structural equation modeling and Ttest analyses, our empirical analysis demonstrates several key findings.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersLeverage Ratio: An empirical study of the European banking system

Siddhartha P. Chakrabarty, Kartikeya Singh, Jatin Dhingra

| Title | Authors | Year | Actions |

|---|

Comments (0)