Summary

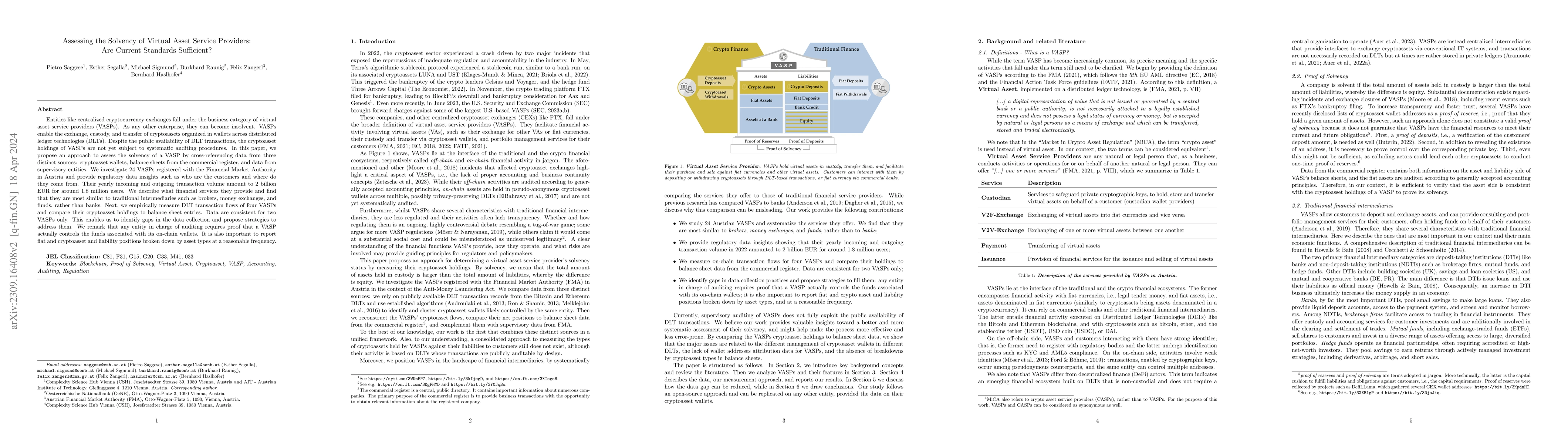

Entities like centralized cryptocurrency exchanges fall under the business category of virtual asset service providers (VASPs). As any other enterprise, they can become insolvent. VASPs enable the exchange, custody, and transfer of cryptoassets organized in wallets across distributed ledger technologies (DLTs). Despite the public availability of DLT transactions, the cryptoasset holdings of VASPs are not yet subject to systematic auditing procedures. In this paper, we propose an approach to assess the solvency of a VASP by cross-referencing data from three distinct sources: cryptoasset wallets, balance sheets from the commercial register, and data from supervisory entities. We investigate 24 VASPs registered with the Financial Market Authority in Austria and provide regulatory data insights such as who are the customers and where do they come from. Their yearly incoming and outgoing transaction volume amount to 2 billion EUR for around 1.8 million users. We describe what financial services they provide and find that they are most similar to traditional intermediaries such as brokers, money exchanges, and funds, rather than banks. Next, we empirically measure DLT transaction flows of four VASPs and compare their cryptoasset holdings to balance sheet entries. Data are consistent for two VASPs only. This enables us to identify gaps in the data collection and propose strategies to address them. We remark that any entity in charge of auditing requires proof that a VASP actually controls the funds associated with its on-chain wallets. It is also important to report fiat and cryptoasset and liability positions broken down by asset types at a reasonable frequency.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

| Title | Authors | Year | Actions |

|---|

Comments (0)