Summary

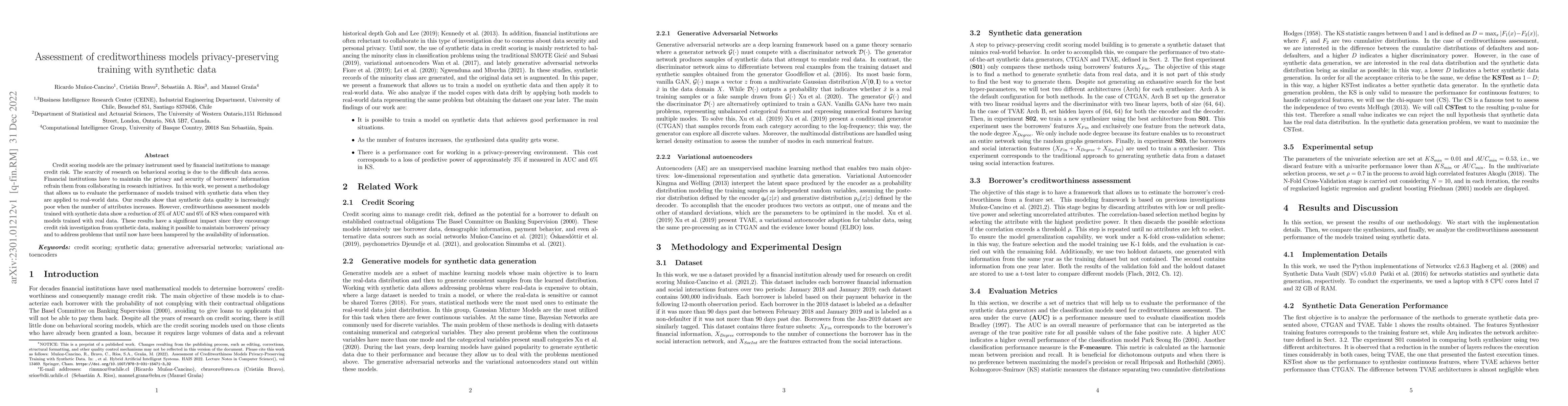

Credit scoring models are the primary instrument used by financial institutions to manage credit risk. The scarcity of research on behavioral scoring is due to the difficult data access. Financial institutions have to maintain the privacy and security of borrowers' information refrain them from collaborating in research initiatives. In this work, we present a methodology that allows us to evaluate the performance of models trained with synthetic data when they are applied to real-world data. Our results show that synthetic data quality is increasingly poor when the number of attributes increases. However, creditworthiness assessment models trained with synthetic data show a reduction of 3\% of AUC and 6\% of KS when compared with models trained with real data. These results have a significant impact since they encourage credit risk investigation from synthetic data, making it possible to maintain borrowers' privacy and to address problems that until now have been hampered by the availability of information.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersPrivacy-Preserving Fair Synthetic Tabular Data

Noman Mohammed, Christopher J. Henry, Fatima J. Sarmin et al.

Does Training with Synthetic Data Truly Protect Privacy?

Jie Zhang, Yunpeng Zhao

SafeSynthDP: Leveraging Large Language Models for Privacy-Preserving Synthetic Data Generation Using Differential Privacy

Md Mahadi Hasan Nahid, Sadid Bin Hasan

KIPPS: Knowledge infusion in Privacy Preserving Synthetic Data Generation

Anupam Joshi, Anantaa Kotal

| Title | Authors | Year | Actions |

|---|

Comments (0)