Summary

The growing penetration of intermittent, renewable generation in US power grids, especially wind and solar generation, results in increased operational uncertainty. In that context, accurate forecasts are critical, especially for wind generation, which exhibits large variability and is historically harder to predict. To overcome this challenge, this work proposes a novel Bundle-Predict-Reconcile (BPR) framework that integrates asset bundling, machine learning, and forecast reconciliation techniques. The BPR framework first learns an intermediate hierarchy level (the bundles), then predicts wind power at the asset, bundle, and fleet level, and finally reconciles all forecasts to ensure consistency. This approach effectively introduces an auxiliary learning task (predicting the bundle-level time series) to help the main learning tasks. The paper also introduces new asset-bundling criteria that capture the spatio-temporal dynamics of wind power time series. Extensive numerical experiments are conducted on an industry-size dataset of 283 wind farms in the MISO footprint. The experiments consider short-term and day-ahead forecasts, and evaluates a large variety of forecasting models that include weather predictions as covariates. The results demonstrate the benefits of BPR, which consistently and significantly improves forecast accuracy over baselines, especially at the fleet level.

AI Key Findings

Generated Sep 07, 2025

Methodology

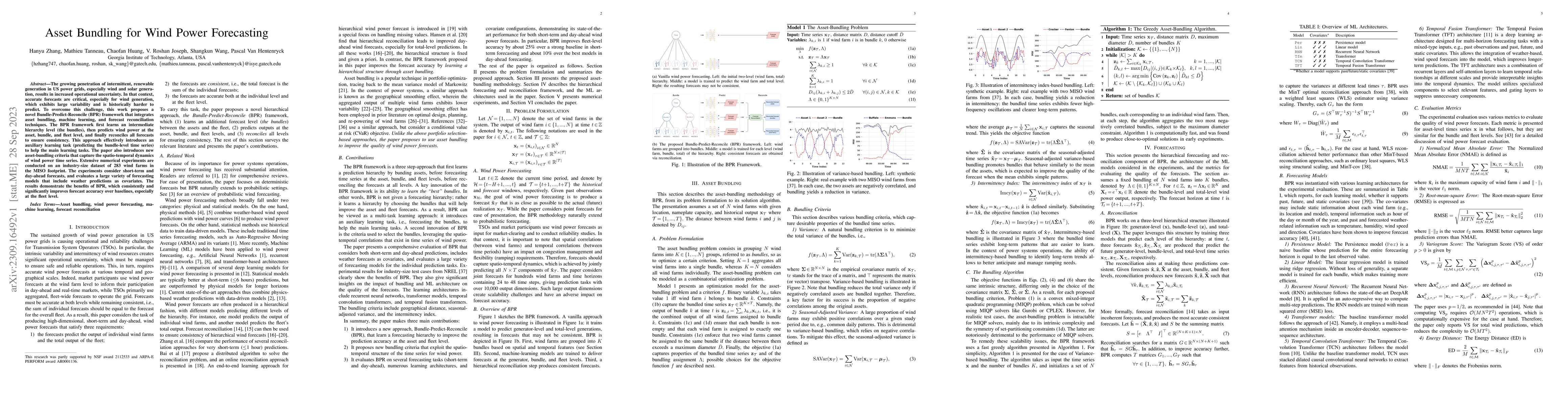

The research proposes a Bundle-Predict-Reconcile (BPR) framework for hierarchical wind power forecasting, integrating asset bundling, machine learning, and forecast reconciliation techniques. It introduces new asset-bundling criteria capturing spatio-temporal dynamics of wind power time series and evaluates the framework on a large industry-size dataset of 283 wind farms in the MISO footprint.

Key Results

- BPR consistently and significantly improves forecast accuracy over baselines, especially at the fleet level.

- TFT with 10 bundles and Imcy criterion achieves the best results overall for day-ahead predictions.

- BPR improves fleet-level accuracy by about 25% (NMAE, RMSE, and ED) and asset-level accuracy by about 14% (RMSE and ED) over the baseline for short-term forecasts.

Significance

This research is significant as it addresses the challenge of increased operational uncertainty in power grids due to intermittent renewable generation, particularly wind and solar power. Accurate forecasts are critical for grid stability and efficient energy management.

Technical Contribution

The BPR framework introduces a novel approach to wind power forecasting by integrating asset bundling, machine learning, and forecast reconciliation techniques, along with new asset-bundling criteria.

Novelty

The proposed BPR framework stands out by introducing an auxiliary learning task (predicting bundle-level time series) to improve main learning tasks, and by evaluating its performance on an industry-size dataset.

Limitations

- The study does not explore the impact of varying time granularities on forecast accuracy in detail.

- Limited comparison with physical models known to improve long-term forecasts.

Future Work

- Apply BPR to probabilistic hierarchical wind power forecasting.

- Investigate the impact of different time granularities on forecast performance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersDEWP: Deep Expansion Learning for Wind Power Forecasting

Wei Fan, Yuanchun Zhou, Jiang Bian et al.

No citations found for this paper.

Comments (0)