Summary

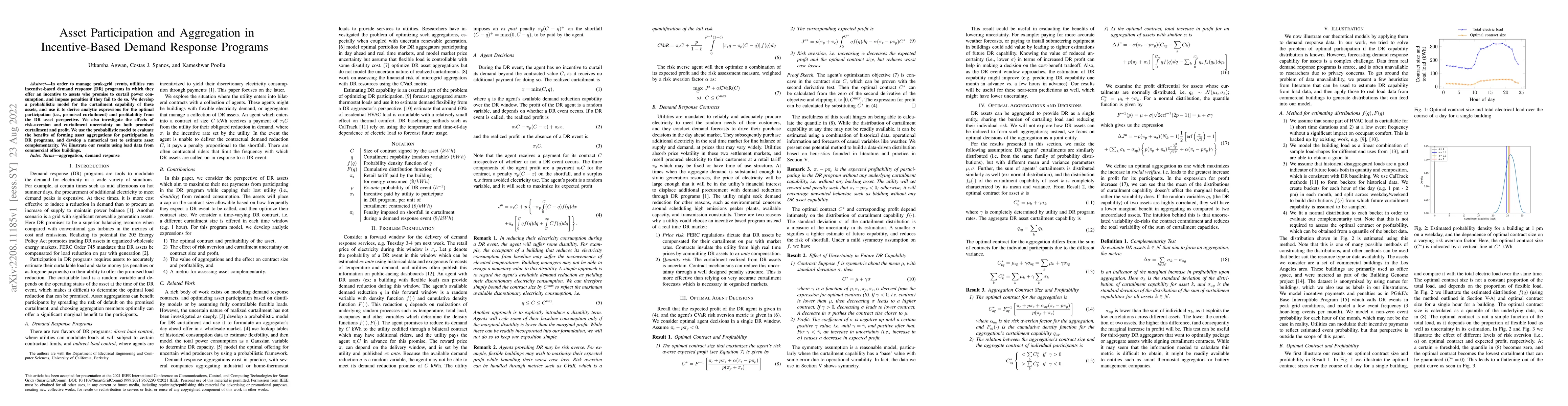

In order to manage peak-grid events, utilities run incentive-based demand response (DR) programs in which they offer an incentive to assets who promise to curtail power consumption, and impose penalties if they fail to do so. We develop a probabilistic model for the curtailment capability of these assets, and use it to derive analytic expressions for the optimal participation (i.e., promised curtailment) and profitability from the DR asset perspective. We also investigate the effects of risk-aversion and curtailment uncertainty on both promised curtailment and profit. We use the probabilistic model to evaluate the benefits of forming asset aggregations for participation in DR programs, and develop a numerical test to estimate asset complementarity. We illustrate our results using load data from commercial office buildings.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)