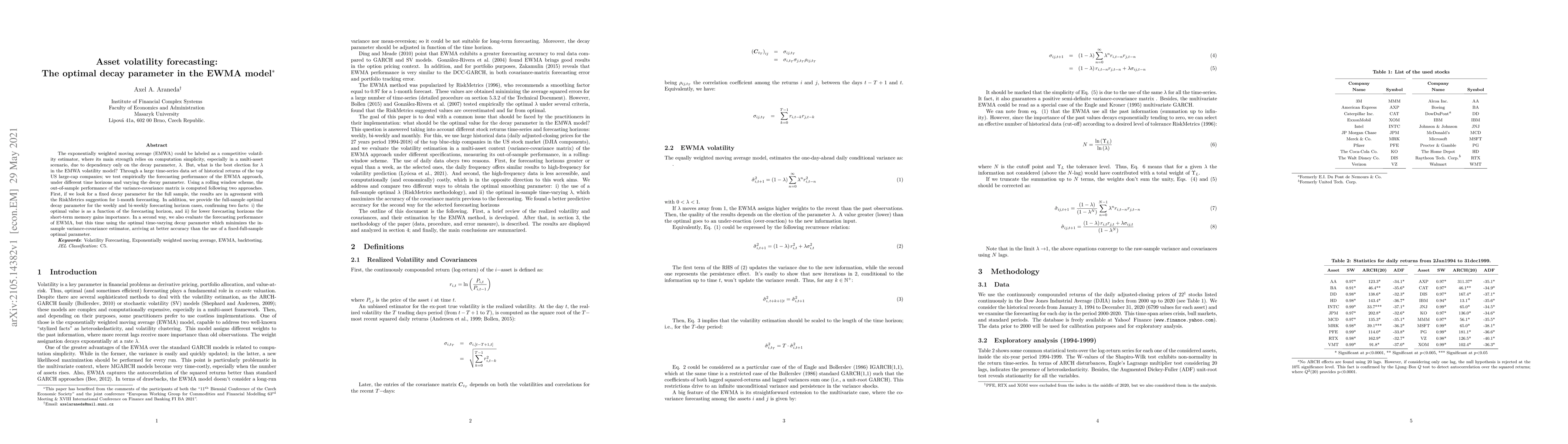

Summary

The exponentially weighted moving average (EMWA) could be labeled as a competitive volatility estimator, where its main strength relies on computation simplicity, especially in a multi-asset scenario, due to dependency only on the decay parameter, $\lambda$. But, what is the best election for $\lambda$ in the EMWA volatility model? Through a large time-series data set of historical returns of the top US large-cap companies; we test empirically the forecasting performance of the EWMA approach, under different time horizons and varying the decay parameter. Using a rolling window scheme, the out-of-sample performance of the variance-covariance matrix is computed following two approaches. First, if we look for a fixed decay parameter for the full sample, the results are in agreement with the RiskMetrics suggestion for 1-month forecasting. In addition, we provide the full-sample optimal decay parameter for the weekly and bi-weekly forecasting horizon cases, confirming two facts: i) the optimal value is as a function of the forecasting horizon, and ii) for lower forecasting horizons the short-term memory gains importance. In a second way, we also evaluate the forecasting performance of EWMA, but this time using the optimal time-varying decay parameter which minimizes the in-sample variance-covariance estimator, arriving at better accuracy than the use of a fixed-full-sample optimal parameter.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersParameter Estimation of the Heston Volatility Model with Jumps in the Asset Prices

Janusz Szwabiński, Jarosław Gruszka

| Title | Authors | Year | Actions |

|---|

Comments (0)