Authors

Summary

Crowdfunding, which is the act of raising funds from a large number of people's contributions, is among the most popular research topics in economic theory. Due to the fact that crowdfunding platforms (CFPs) have facilitated the process of raising funds by offering several features, we should take their existence and survival in the marketplace into account. In this study, we investigated the significant role of platform features in a customer behavioral choice model. In particular, we proposed a multinomial logit model to describe the customers' (backers') behavior in a crowdfunding setting. We proceed by discussing the revenue-sharing model in these platforms. For this purpose, we conclude that an assortment optimization problem could be of major importance in order to maximize the platforms' revenue. We were able to derive a reasonable amount of data in some cases and implement two well-known machine learning methods such as multivariate regression and classification problems to predict the best assortments the platform could offer to every arriving customer. We compared the results of these two methods and investigated how well they perform in all cases.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

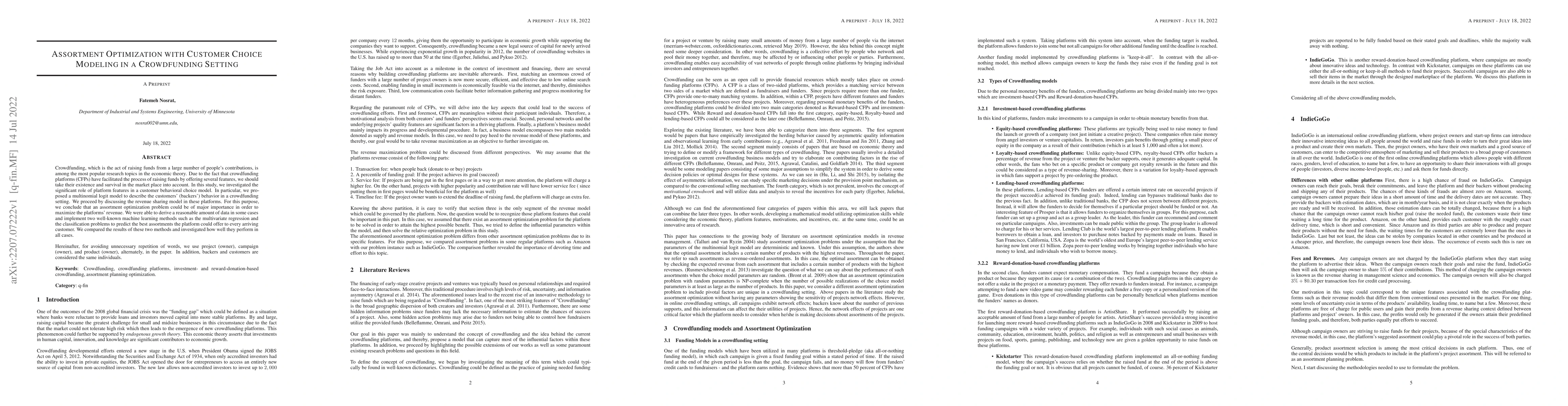

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersA Neural Network Based Choice Model for Assortment Optimization

Zhongze Cai, Xiaocheng Li, Hanzhao Wang et al.

No citations found for this paper.

Comments (0)