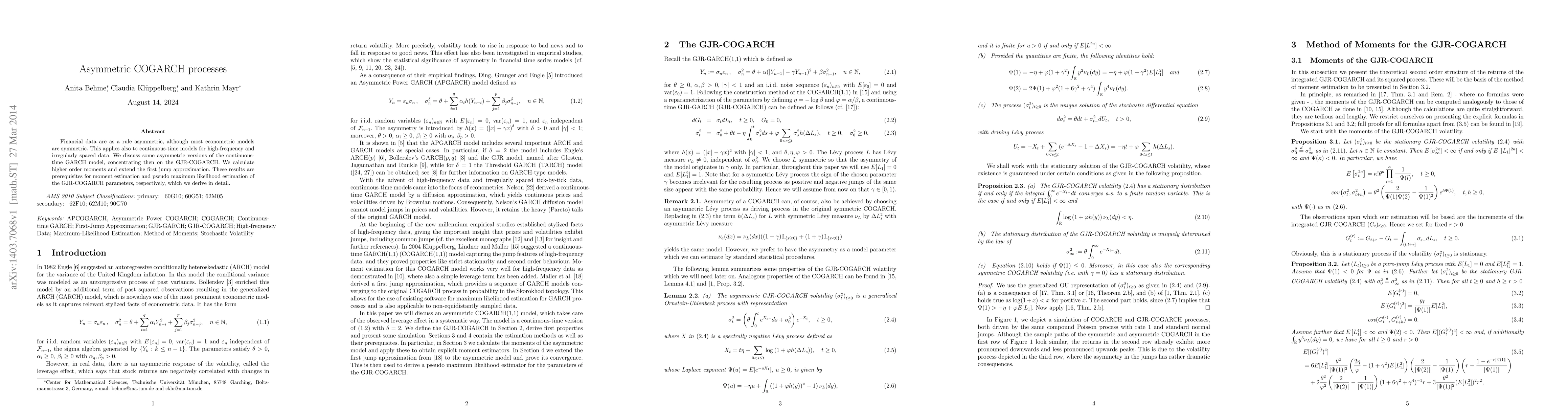

Summary

Financial data are as a rule asymmetric, although most econometric models are symmetric. This applies also to continuous-time models for high-frequency and irregularly spaced data. We discuss some asymmetric versions of the continuous-time GARCH model, concentrating then on the GJR-COGARCH. We calculate higher order moments and extend the first jump approximation. These results are prerequisites for moment estimation and pseudo maximum likelihood estimation of the GJR-COGARCH parameters, respectively, which we derive in detail.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Comments (0)