Summary

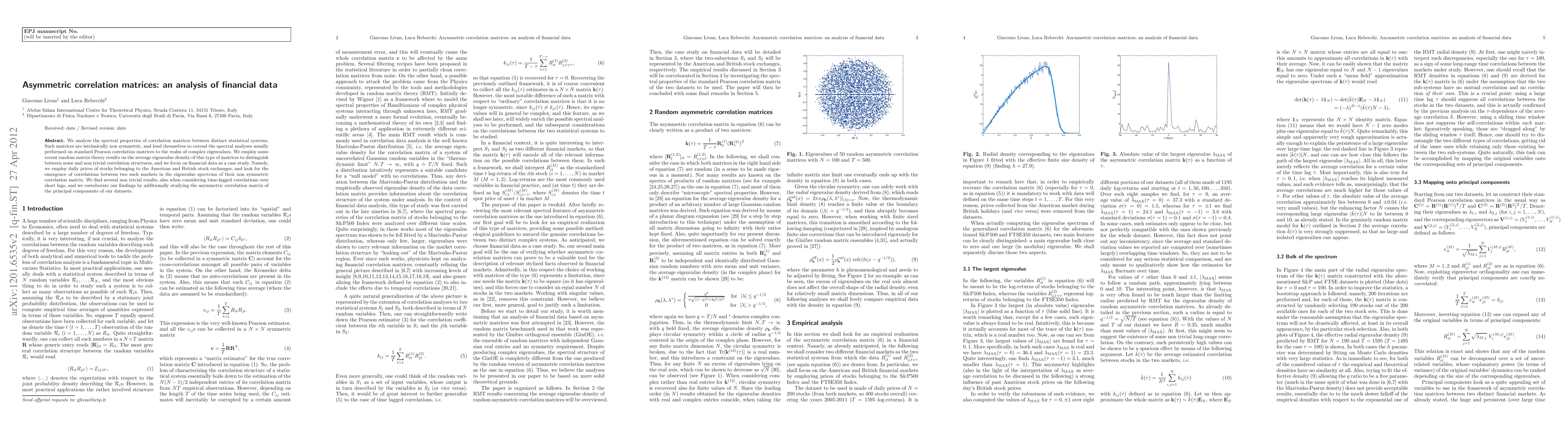

We analyze the spectral properties of correlation matrices between distinct statistical systems. Such matrices are intrinsically non symmetric, and lend themselves to extend the spectral analyses usually performed on standard Pearson correlation matrices to the realm of complex eigenvalues. We employ some recent random matrix theory results on the average eigenvalue density of this type of matrices to distinguish between noise and non trivial correlation structures, and we focus on financial data as a case study. Namely, we employ daily prices of stocks belonging to the American and British stock exchanges, and look for the emergence of correlations between two such markets in the eigenvalue spectrum of their non symmetric correlation matrix. We find several non trivial results, also when considering time-lagged correlations over short lags, and we corroborate our findings by additionally studying the asymmetric correlation matrix of the principal components of our datasets.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)