Summary

This paper proposes the asymmetric linear double autoregression, which jointly models the conditional mean and conditional heteroscedasticity characterized by asymmetric effects. A sufficient condition is established for the existence of a strictly stationary solution. With a quasi-maximum likelihood estimation (QMLE) procedure introduced, a Bayesian information criterion (BIC) and its modified version are proposed for model selection. To detect asymmetric effects in the volatility, the Wald, Lagrange multiplier and quasi-likelihood ratio test statistics are put forward, and their limiting distributions are established under both null and local alternative hypotheses. Moreover, a mixed portmanteau test is constructed to check the adequacy of the fitted model. All asymptotic properties of inference tools including QMLE, BICs, asymmetric tests and the mixed portmanteau test, are established without any moment condition on the data process, which makes the new model and its inference tools applicable for heavy-tailed data. Simulation studies indicate that the proposed methods perform well in finite samples, and an empirical application to S\&P500 Index illustrates the usefulness of the new model.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

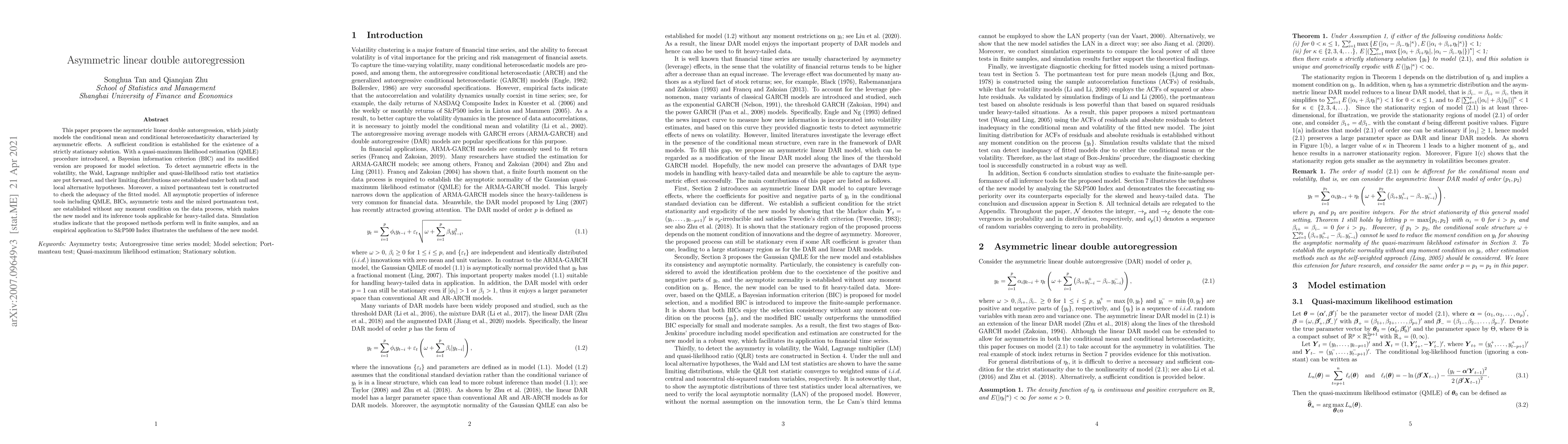

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersAutoregressive Asymmetric Linear Gaussian Hidden Markov Models

Carlos Puerto-Santana, Concha Bielza, Pedro Larrañaga

| Title | Authors | Year | Actions |

|---|

Comments (0)