Summary

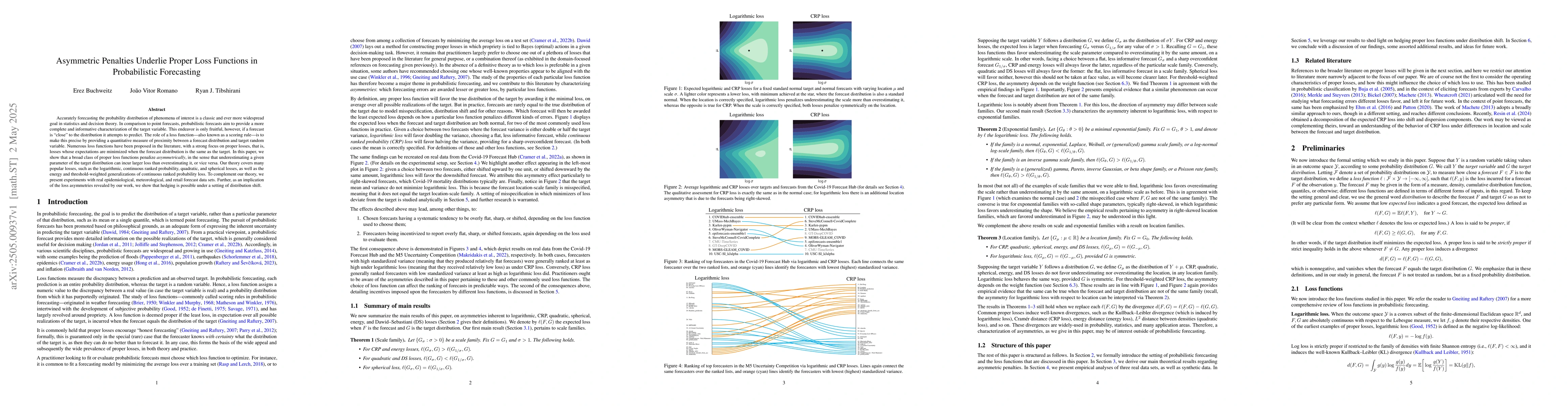

Accurately forecasting the probability distribution of phenomena of interest is a classic and ever more widespread goal in statistics and decision theory. In comparison to point forecasts, probabilistic forecasts aim to provide a more complete and informative characterization of the target variable. This endeavor is only fruitful, however, if a forecast is "close" to the distribution it attempts to predict. The role of a loss function -- also known as a scoring rule -- is to make this precise by providing a quantitative measure of proximity between a forecast distribution and target random variable. Numerous loss functions have been proposed in the literature, with a strong focus on proper losses, that is, losses whose expectations are minimized when the forecast distribution is the same as the target. In this paper, we show that a broad class of proper loss functions penalize asymmetrically, in the sense that underestimating a given parameter of the target distribution can incur larger loss than overestimating it, or vice versa. Our theory covers many popular losses, such as the logarithmic, continuous ranked probability, quadratic, and spherical losses, as well as the energy and threshold-weighted generalizations of continuous ranked probability loss. To complement our theory, we present experiments with real epidemiological, meteorological, and retail forecast data sets. Further, as an implication of the loss asymmetries revealed by our work, we show that hedging is possible under a setting of distribution shift.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersRanking probabilistic forecasting models with different loss functions

Bartosz Uniejewski, Tomasz Serafin

MVG-CRPS: A Robust Loss Function for Multivariate Probabilistic Forecasting

Lijun Sun, Vincent Zhihao Zheng

No citations found for this paper.

Comments (0)