Summary

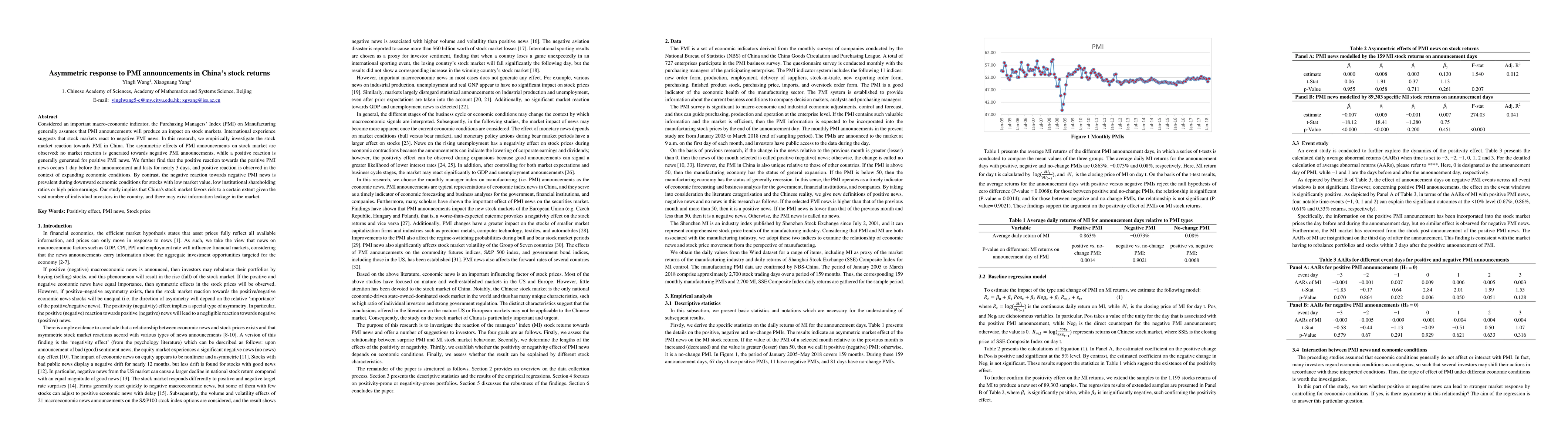

Considered an important macroeconomic indicator, the Purchasing Managers' Index (PMI) on Manufacturing generally assumes that PMI announcements will produce an impact on stock markets. International experience suggests that stock markets react to negative PMI news. In this research, we empirically investigate the stock market reaction towards PMI in China. The asymmetric effects of PMI announcements on the stock market are observed: no market reaction is generated towards negative PMI announcements, while a positive reaction is generally generated for positive PMI news. We further find that the positive reaction towards the positive PMI news occurs 1 day before the announcement and lasts for nearly 3 days, and the positive reaction is observed in the context of expanding economic conditions. By contrast, the negative reaction towards negative PMI news is prevalent during downward economic conditions for stocks with low market value, low institutional shareholding ratios or high price earnings. Our study implies that China's stock market favors risk to a certain extent given the vast number of individual investors in the country, and there may exist information leakage in the market.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)