Summary

We consider the problem of portfolio optimization in a simple incomplete market and under a general utility function. By working with the associated Hamilton-Jacobi-Bellman partial differential equation (HJB PDE), we obtain a closed-form formula for a trading strategy which approximates the optimal trading strategy when the time horizon is small. This strategy is generated by a first order approximation to the value function. The approximate value function is obtained by constructing classical sub- and super-solutions to the HJB PDE using a formal expansion in powers of horizon time. Martingale inequalities are used to sandwich the true value function between the constructed sub- and super-solutions. A rigorous proof of the accuracy of the approximation formulas is given. We end with a heuristic scheme for extending our small-time approximating formulas to approximating formulas in a finite time horizon.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

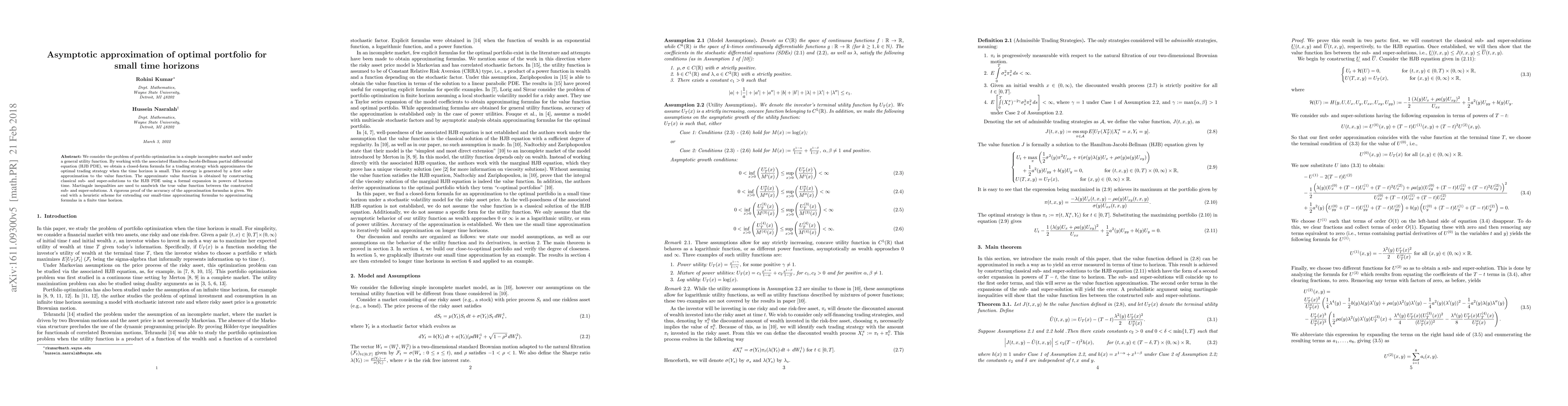

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersAnalysis of optimal portfolio on finite and small time horizons for a stochastic volatility market model

Minglian Lin, Indranil SenGupta

Analysis of optimal portfolio on finite and small-time horizons for a stochastic volatility model with multiple correlated assets

Minglian Lin, Indranil SenGupta

No citations found for this paper.

Comments (0)