Summary

We study asymptotic properties of maximum likelihood estimators of drift parameters for a jump-type Heston model based on continuous time observations, where the jump process can be any purely non-Gaussian L\'evy process of not necessarily bounded variation with a L\'evy measure concentrated on $(-1,\infty)$. We prove strong consistency and asymptotic normality for all admissible parameter values except one, where we show only weak consistency and mixed normal (but non-normal) asymptotic behavior. It turns out that the volatility of the price process is a measurable function of the price process. We also present some numerical illustrations to confirm our results.

AI Key Findings

Generated Sep 07, 2025

Methodology

The paper employs a rigorous mathematical approach, utilizing stochastic calculus and likelihood theory to analyze the asymptotic behavior of maximum likelihood estimators (MLE) for a jump-type Heston model. It considers continuous-time observations with a jump process that can be any purely non-Gaussian Lévy process of non-necessarily bounded variation, with a Lévy measure concentrated on $(-1,\infty)$.

Key Results

- The paper proves strong consistency and asymptotic normality for all admissible parameter values except one, where it shows only weak consistency and mixed normal (but non-normal) asymptotic behavior.

- It establishes that the volatility of the price process is a measurable function of the price process.

- Numerical illustrations are presented to confirm the theoretical results.

Significance

This research is significant as it provides a detailed analysis of the asymptotic properties of MLEs for a jump-type Heston model, which is crucial for accurate financial modeling and risk management, especially in scenarios involving jump processes.

Technical Contribution

The paper's technical contribution lies in proving strong consistency and asymptotic normality for MLEs under specified conditions, identifying a unique parameter value for which only weak consistency and mixed normal behavior are shown.

Novelty

The novelty of this work is in its comprehensive analysis of the asymptotic properties of MLEs for a jump-type Heston model, particularly in distinguishing between strong and weak consistency and normal versus mixed normal asymptotic behavior for almost all parameters.

Limitations

- The study is limited to continuous-time observations and does not explore discrete-time observations.

- The paper assumes specific conditions on the Lévy process, which might restrict the applicability to more general processes.

Future Work

- Future work could extend the analysis to discrete-time observations and explore a broader class of Lévy processes.

- Investigating the performance of these estimators under different market conditions and with more complex models could be beneficial.

Paper Details

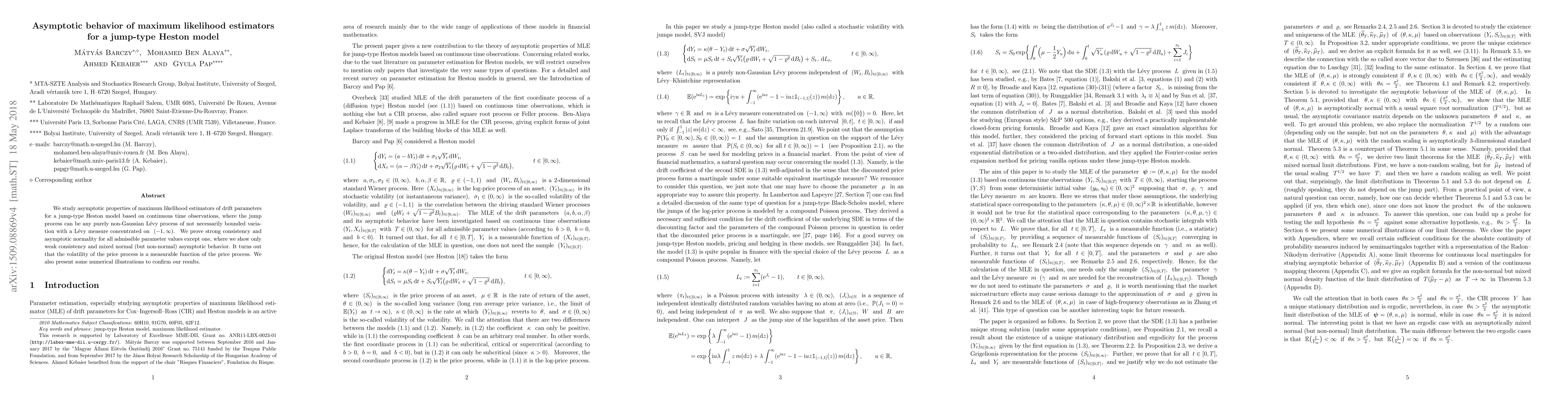

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

| Title | Authors | Year | Actions |

|---|

Comments (0)