Summary

We study the asymptotic behaviour of a class of small-noise diffusions driven by fractional Brownian motion, with random starting points. Different scalings allow for different asymptotic properties of the process (small-time and tail behaviours in particular). In order to do so, we extend some results on sample path large deviations for such diffusions. As an application, we show how these results characterise the small-time and tail estimates of the implied volatility for rough volatility models, recently proposed in mathematical finance.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

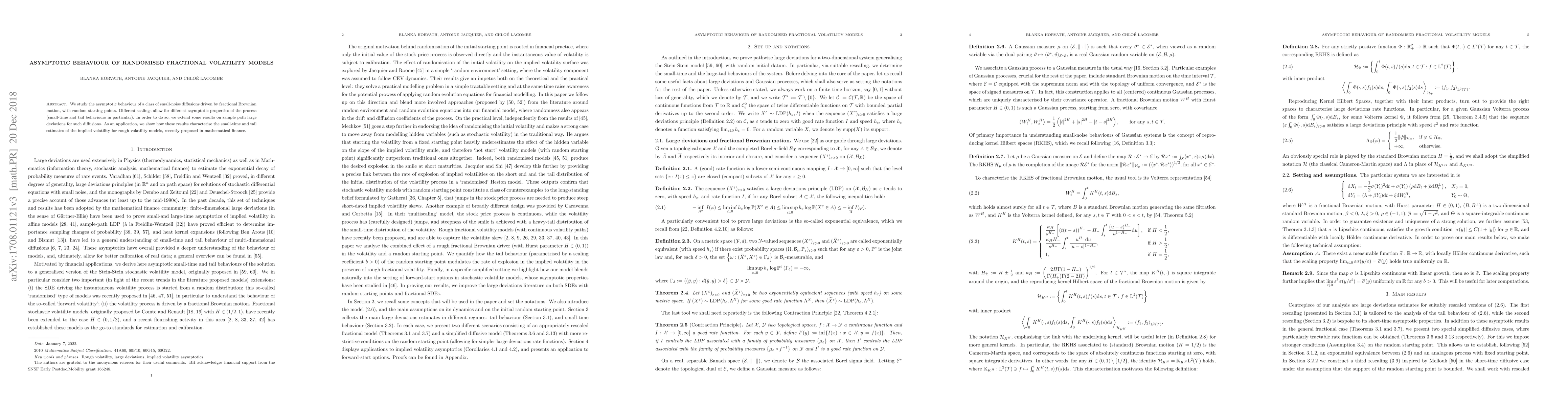

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)