Summary

In this note, we derive the characteristic function expansion for logarithm of the underlying asset price in corrected Heston model as proposed by Fouque and Lorig.

AI Key Findings

Generated Sep 03, 2025

Methodology

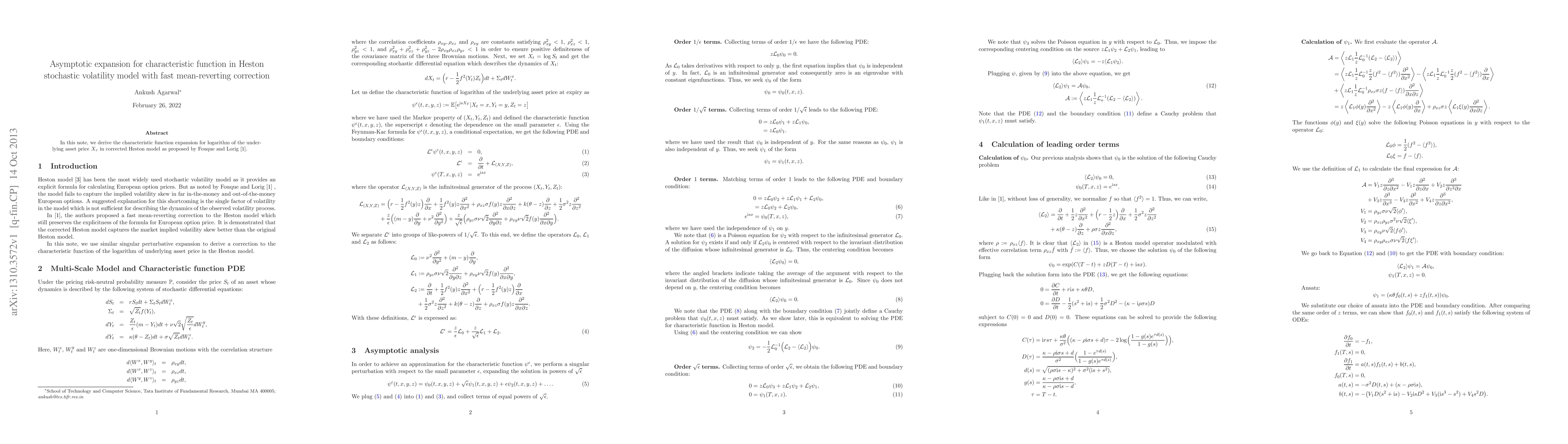

The paper derives an asymptotic expansion for the characteristic function of the logarithm of the underlying asset price in a corrected Heston stochastic volatility model using singular perturbation with respect to a small parameter ǫ, expanding the solution in powers of √ǫ.

Key Results

- An asymptotic expansion for the characteristic function ψǫ(t, x, y, z) is obtained by separating the operator Lǫ into groups of like powers of 1/√ǫ.

- Leading-order terms ψ0(t, x, z) are calculated by solving a Cauchy problem defined by a Poisson equation with the Heston model operator modulated by an effective correlation term.

- Higher-order terms ψ1(t, x, z) and ψ2(t, x, y, z) are derived using Poisson equations for ψ1 and ψ2, with ψ2 expressed in terms of ψ0.

Significance

This research provides a method to correct the characteristic function of the Heston model, which can be used to derive improved implied volatility asymptotics, capturing market skew more efficiently.

Technical Contribution

The paper presents a systematic approach for obtaining an asymptotic expansion of the characteristic function in a corrected Heston stochastic volatility model, separating the perturbation operator into groups of like powers of 1/√ǫ and solving associated Poisson equations for each order.

Novelty

This work extends previous research by Fouque and Lorig by providing a detailed asymptotic analysis and explicit expressions for higher-order terms in the characteristic function expansion.

Limitations

- The paper does not provide explicit numerical examples or comparisons with empirical data to validate the asymptotic expansion.

- The analysis assumes constant correlation coefficients, which may not fully represent real-world market dynamics.

Future Work

- Apply the corrected characteristic function formula to derive improved implied volatility asymptotics in the corrected Heston model.

- Investigate the impact of time-varying correlation coefficients on the accuracy of the asymptotic expansion.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersNo citations found for this paper.

Comments (0)