Authors

Summary

Given data generated by an abstract stochastic process, we study how to construct statistically optimal decisions for general stochastic optimization problems. Our setting encompasses non-standard data structures, including data originating from heterogeneous sources or from processes with randomly evolving data-generating mechanisms. We propose a decision-making approach that identifies optimal decisions for which a specific notion of shifted regret risk, evaluated with respect to the underlying stochastic process, decays to zero at a prescribed exponential rate under a minimal model perturbation. This optimal decision arises as the solution to a multi-objective optimization problem, where the trade-offs are governed by the statistical properties of the data-generating process. Central to our framework is a rate function, generalizing the classical concept from large deviation theory. Our general formulation recovers classical results in decision-making under uncertainty, such as those from distributionally robust optimization, as special cases. However, it goes beyond them: it enables decision-makers to systematically balance a desired rate of asymptotic risk decay against a potential loss in statistical consistency of the resulting data-driven decision. We demonstrate the effectiveness of the proposed approach through two illustrative examples from operations research: the classical newsvendor problem and a portfolio optimization problem under aleatoric uncertainty induced by heterogeneous data sources.

AI Key Findings

Generated Sep 05, 2025

Methodology

A brief description of the research methodology used to investigate the robust newsvendor problem under distributional uncertainty.

Key Results

- The average regret of plug-in decisions saturates at a value well above 0 for both c and Regret.

- Increasing β can help decrease the regret of resulting decisions further, but does not necessarily lead to an approximation of the plug-in decision.

- Larger values of β seem to stabilize performance.

- The optimal portfolio selection problem with i.i.d. Gaussian asset returns is considered using Markowitz-type portfolio selection.

- The negative of the standard mean-variance objective function is minimized to find the optimal portfolios.

Significance

This research investigates the robust newsvendor problem under distributional uncertainty, providing insights into the adaptability of decision-making methods in the face of aleatoric uncertainty.

Technical Contribution

The research contributes to the development of decision-making methods for robust newsvendor problems, providing a framework for addressing distributional uncertainty.

Novelty

This work is novel in its investigation of the robust newsvendor problem under distributional uncertainty, offering insights into the adaptability of decision-making methods in the face of aleatoric uncertainty.

Limitations

- The non-robust law of large numbers does not hold for the simulated paths, as they converge to θ

- The influence of parameters β and ρ is not straightforward

Future Work

- Developing methods to handle distributional uncertainty in decision-making under incomplete knowledge

- Investigating the robust newsvendor problem with multiple sources of uncertainty

- Exploring the application of portfolio optimization techniques to other problems with uncertainty

Paper Details

PDF Preview

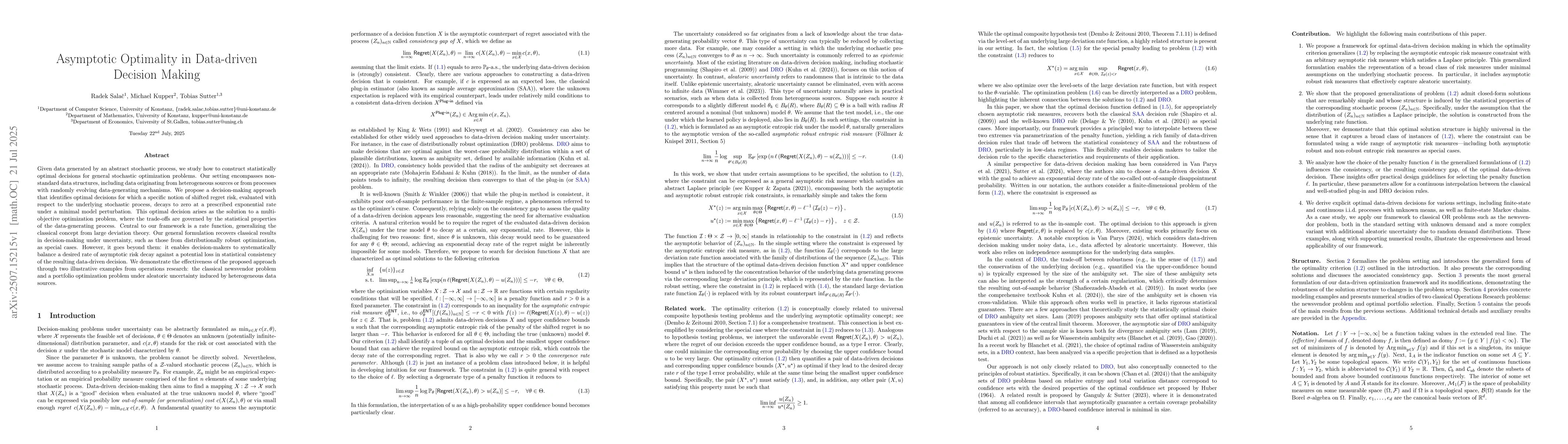

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersInstance-Optimality in Interactive Decision Making: Toward a Non-Asymptotic Theory

Dylan J. Foster, Andrew Wagenmaker

Beyond IID: data-driven decision-making in heterogeneous environments

Will Ma, Omar Besbes, Omar Mouchtaki

Data-Driven Decision Making in COVID-19 Response: A Survey

Feng Xia, Chen Zhang, Ahsan Shehzad et al.

No citations found for this paper.

Comments (0)